While it seems that COVID-19 is largely under control, the pandemic continues to affect supply chains in a profound way, according to latest global trade data from Descartes Datamyne. This includes new disruption of manufacturing and logistics operations with further lockdown and quarantine orders. And exacerbating the situation is the current imbalance of containers globally.

The pandemic has altered other facets of life and business – wearing a mask when outdoors or among a large group of people, working remotely, turning more to online shopping to name a few. In some cases, though the changes have been more structural such as the shift in the disposable income habits of Americans, which has had a direct impact on the severity and length of the global shipping crisis.

America’s Shift Away from an “Experience Economy”?

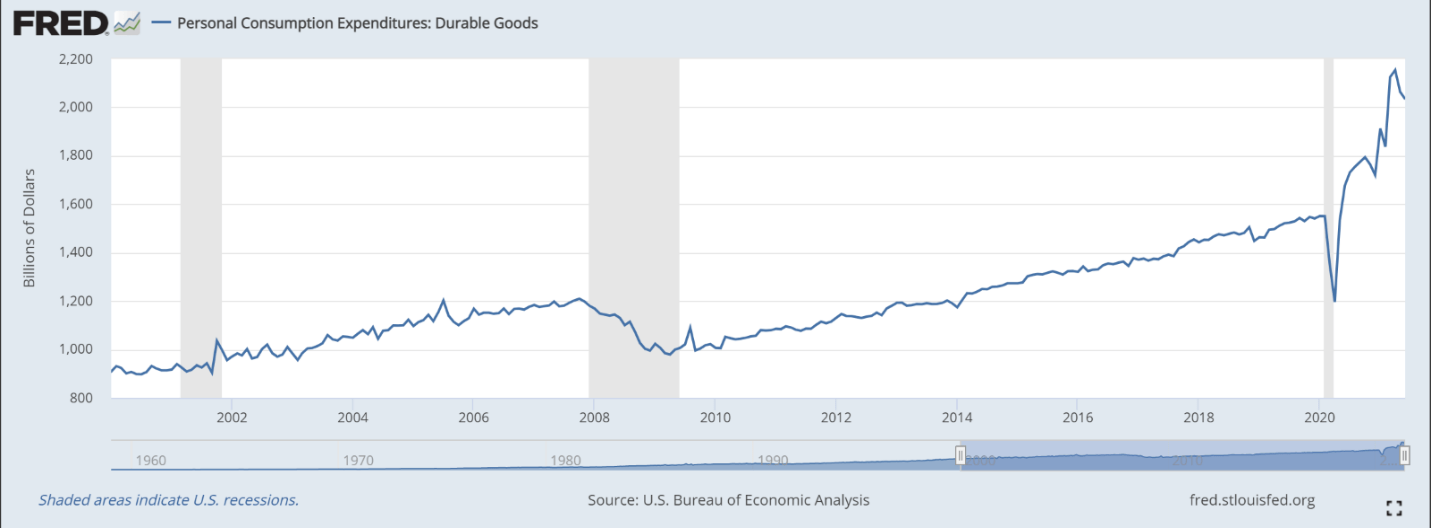

Before COVID-19, America was in the “Experience Economy”, where people’s preference was to spend their money on experiential items such as travel and events, rather that purchase “material things”. Over the course of a couple months at the height of the pandemic, that all changed. At the same time, however, disposable incomes among Americans, in general, did not decline. So instead of “doing something”, they turned to “buying something” in order to meet the needs of the moment. That is, being at home more, working from their residence, and stocking up for the worst-case scenario. This translated into sharply higher sales of durable goods, or “stuff”. Everything, in fact, from appliances to furniture and outdoor sporting equipment. (See Figure 1).

Figure 1: Increase in Demand for Durable Goods

Source: U.S. Bureau of Economic Analysis

Impact of this Shift on International Supply Chains

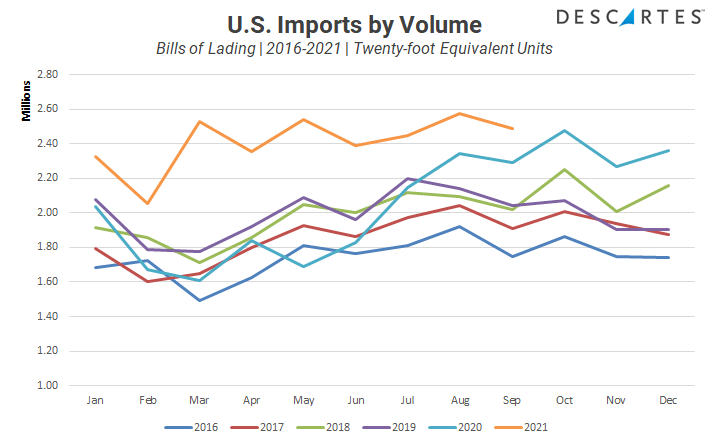

Some might ask how we can make the assumption that the stuff economy is a major contributor to the global shipping crisis. The answer is that the U.S. is an import economy. That means it imports more goods than it makes. This can be seen in global trade data numbers from Descartes Datamyne (see figure 2). But it is the surging import figures from the latter half of 2020 and this year which show the real extent of the current shipping crisis.

Figure 2: 2016-2021 Container Volume Comparison

When reviewing overall ocean container import volumes, it can be seen that the shift to the stuff economy occurred in mid-2020 (see Figure 2). And since that time, it has grown significantly beyond the last “normal” year of 2019, before the pandemic. In fact, the last 12 months container import volume (ending July 2021) was 19% above the 2019 total container import volume. This level of increase in a short time would put a strain on any logistics ecosystem, pandemic or not.

The stuff economy is an example of how shifting macroeconomic conditions can materially affect supply chains and why it is important to track broader changes in trade flows that may not even be related to your industry. Since consumer spending forms a large part of the U.S. economy, its impact on global shipping is all about the battle for the consumer’s wallet. Until the service-based industries (e.g. global tourism and travel) rebound, consumers feel they have their fair share of stuff or the economic situation of most Americans deteriorates, it is likely that the stuff economy will continue to drive global shipping volumes, making it more challenging for importers and their LSP partners to ship goods to their destination.

Get the Essential Guide to Supply Chain Resiliency

As carriers and ports work through the global shipping crisis and the subsequent backlog, now is the time for you to invest in your supply chain resiliency.

Our essential guide has been developed to help you mitigate risks and protect your business from costly disruptions.

What does the future hold for global shipping?

The current shipping crisis is not likely to be resolved until the latter part of 2022, if industry trends we see now are anything to go by. But as of this point in the fall of 2021, we are clearly well into the annual peak shipping season, with TEU volumes hovering between 2.4M and 2.6M per month.

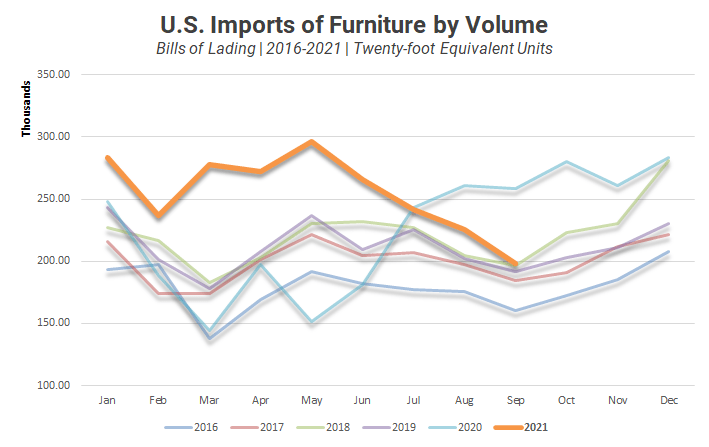

But even in the midst of continued record-setting import volumes, there are pockets of decline that might indicate a potential return to normalcy. The monthly import volumes for high-volume, durable goods such as furniture have steadily declined since May and have now returned to the expected levels, as the chart below demonstrates.

Figure 3: 2016-2021 Monthly Furniture Imports

The key takeaway is that importers and their logistics partners need to view the global shipping crisis as a problem that won’t go away in the short term.

As events unfold, Descartes will continue to provide monthly highlights to give the industry regular updates about the ongoing global shipping crisis. In the meantime, importers should be thinking about getting the global trade data and market insights they need to help them rearchitect their supply chains to make them more resilient in order to minimize any delays they might encounter in delivering their goods. With Thanksgiving and Christmas just around the corner, this is now more important. Missing this move could mean

How Descartes Can Help

Making the supply chain more resilient is dependent on access to global trade data because it enables supply chain visibility, and allows organizations to:

Find available freight capacity quickly and easily.

- Avoid inventory problems and deviations during shipment.

- Streamline data collection and market analysis.

- Offer better consumer service options and opportunities.

- Respond faster to disruptions and difficulties in the supply chain.

- Improve profits while reducing overall costs.

In addition to making better informed business decisions and market determinations, global trade intelligence allows businesses to identify potential disruptions and establish a more resilient supply chain; however, this is only possible with robust, flexible, and scalable solutions.

With a comprehensive database of accurate, up-to-date import-export information, powered by the Bill of Lading and Census data of 230 markets across 5 continents, Descartes Datamyne enables risk reduction through supplier diversification. By identifying alternate suppliers based on Harmonized System Codes, users can search across multiple nations and sort by country of origin. Users can then narrow the search to identify suppliers based on port of delivery.

Outside of identifying alternate suppliers, global trade content also allows companies to foresee potential disruptions before they occur. By examining market overviews and historical trends, users can identify demand shifts and coordinate their supply chains accordingly.