Data shows trade diverted from China to suppliers in Korea, Thailand, India

Get ready for revved up debate on US tariffs on Chinese tires, set to expire September 26.

As we’ve noted before, the US tariffs imposed in 2009 signaled a course change in US trade policy and triggered a low-grade trade war between the two countries.

Some background: In April 2009, the United Steel Workers union petitioned the US International Trade Commission (ITC) for an investigation into tires under Section 421 of the Trade Act of 1974, a statute aimed at stopping surges in imports from China that hurt US industry. The ITC concluded that passenger vehicle and light truck tires from China were disrupting the market for US producers and recommended three years of tariffs. The Obama administration set the tariffs at 35% ad valorem for the first year, 30% for the second, and 25% for the third year.

The primary aim of the tariffs, according to the petitioners and the administration, was to increase US jobs. The USW says they have (e.g., this report from the Alliance for American Manufacturing). Critics say nay (e.g., this brief from the US-China Business Council). The argument over whether US workers have won more in job opportunities or lost more due to higher-priced tires will no doubt heat up as the decision to extend the tariffs or let them expire nears.

What is clear is that the tariffs diverted trade from China to other offshore suppliers, with Korea, Thailand, and Indonesia among the big gainers.

We took a look at Datamyne’s bill of lading data on US imports to see how the diversion has affected US tire companies.

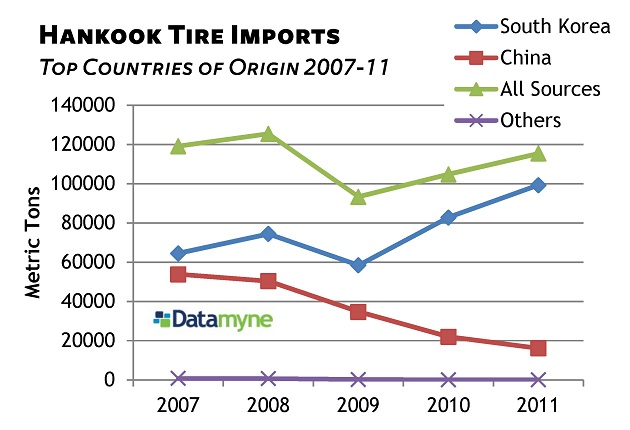

Start with Hankook Tire America, top-ranked consignee by volume for US imports of tires, having received 34,502 metric tons in shipments in first-quarter 2012. Our five-year trend data (below) shows the fall-off in imports from China offset by shipments from South Korea. As the data on Hankook’s offshore suppliers over the rolling year April 2011 through March 2012 (from our new Datamyne Profiles feature) shows, this has entailed sourcing from other siblings within the South Korean-based multinational’s family of companies. Watch for shipments from PT Hankook Tires Indonesia to figure prominently in the mix as that subsidiary’s new West Java plant begins operations in the fourth quarter. This year’s production is reported to be earmarked for the US.

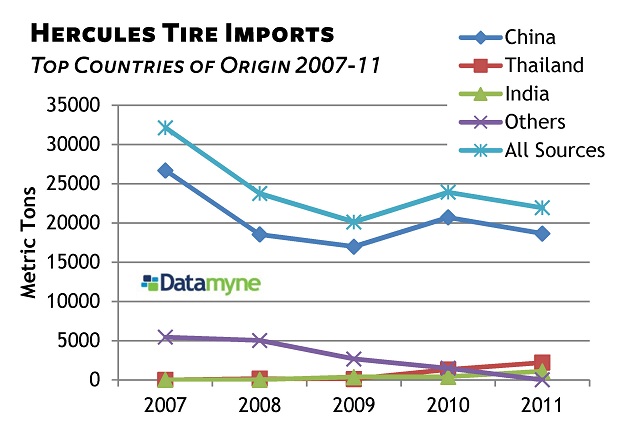

We reached down to 14th ranked tire importer (with 4,737 Mtons in shipments in first-quarter 2012) Hercules Tires because it deals in more of the lower-end tires targeted by the tariffs. The five-year trend data shows imports from all sources echoing the ups and downs of Chinese imports, but there is lift in shipments from Thailand and India. The Datamyne Profiles information indicates the suppliers are Deestone Radial Tire in Thailand and TVS Srichakra in India.