OFAC and BIS rule changes reverse some – but not all – liberalized polices on travel and trade with Cuba; the Cuba Restricted List lengthens.

Treasury Dept.’s Office of Foreign Assets Control (OFAC) has announced that the Cuban Assets Control Regulations will be tightened, curbing U.S. travel and trade with Cuba, effective as of November 9.

The amended regulations implement President Trump’s National Security Presidential Memorandum of June 16. Their purpose, according to the OFAC statement, is to steer individuals and entities subject to U.S. jurisdiction away from doing business with Cuba’s military, intelligence and security services, while maintaining opportunities to travel to the island and to support the small private sector there.

The Obama administration adopted regulatory policies aimed at re-opening diplomatic and commercial relations with Cuba. However, most business transactions remained prohibited under the U.S. embargo on Cuba, which can only be lifted by Congressional action. As the Miami Herald reports, the Trump administration has now rolled back some – but not all – of the liberalized regulations of the previous administration.

U.S. persons are now prohibited from doing business with 180 entities that have ties to the Cuban government’s military security agencies. The list includes entities directly serving the defense and securities sectors, ministries, holding companies and their subsidiaries – as well as 83 hotels, 10 stores, 5 marinas, and 2 tourist agencies.

The tightened sanctions bar U.S. companies from investing in the Mariel economic zone. Almacenes Universales and Terminal de Contenedores de Mariel, S.A., the companies that run the Mariel port facilities are on the prohibited list. Cuban air- and seaports are otherwise exempt from the new restrictions.

The regulations expand the list of Cuban officials who cannot receive remittances and gift parcels from the United States. Remittances to Cuban nationals for humanitarian projects, support for the Cuban people, or development of private business are generally authorized.

Travel arrangements already booked and business deals already struck are grandfathered.

The rules for permissible travel to the island in future are more stringent. For instance, individual “people-to-people” trips are prohibited. Trips to promote exchanges with the Cuban people must be group trips guided by an authorized representative of a sponsoring organization. Visits to the island by Cuban Americans are allowed. Tourism is, as it has been under the embargo, prohibited.

Trade with Cuba: BIS Export Licenses

The Bureau of Industry and Security (BIS) has also amended its rules primarily to extend existing prohibitions on trade to the new additions to the Cuban Restricted List. However, the BIS has simplified the License Exception Support rule that permits exports or reexports for use by the Cuban private sector. Where specific items for export were listed, the rule now applies generally to any items so long as they are not used primarily to generate revenues for, or contribute to the operation of the Cuban government. According to the Herald, among the items that may now be sent to Cuban entrepreneurs are kitchen appliances (for restaurants) and cars (for private taxi drivers).

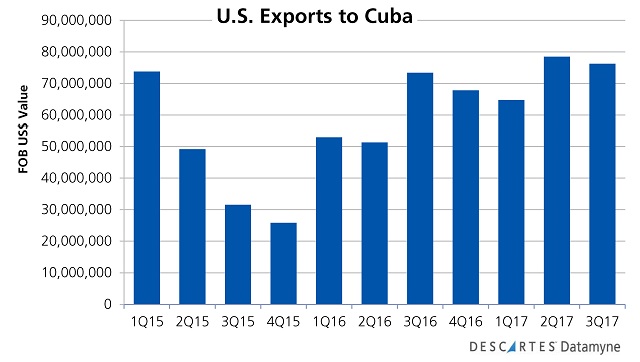

Our trade data shows a lift in U.S. exports to Cuba following liberalization of trade restrictions, as illustrated in this chart:

Our data also indicates that most of these exports are agricultural products – 92.6% this year through the third quarter. Here are the top 10:

Related:

From our blog:

- Road to Cuba for U.S. Exporters

- Next Door but Off-Limits: Cuban Market for U.S. Agri Exports

- Miami Herald Analyzes Our Data on Florida-Cuba Trade

From our trade content solutions:

- Descartes MK Denied Party Screening™continuously updates a database of sanctions, denied and restricted parties – available via web-based Software as a Service (SaaS) solution, bulk screenings, dynamic screening, and Enterprise Resource Planning (ERP) connectivity.