Rising U.S. ethanol exports are facing new tariffs in key markets – first China and now Brazil. Will protectionism reshape the renewable fuels market?

U.S. ethanol exports have been hit with a new tariff by top market Brazil. Industry watchers, who keep close tabs on the tariffs, quotas and trade policies that shape the global market for renewables, had been anticipating this development.

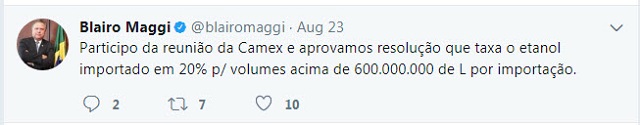

After mulling over a decision for months, CAMEX, Brazil’s Chamber of Foreign Trade, approved a tariff sought by the sugarcane industry – as Brazilian Minister of Agriculture, Livestock and Supply Blairo Maggi tweeted on August 23:

Effective September 1, 2017, the tariff is set to remain in place for two years. The 20% duty kicks in for shipments above an annual cap of 600 million liters (158 million gallons).

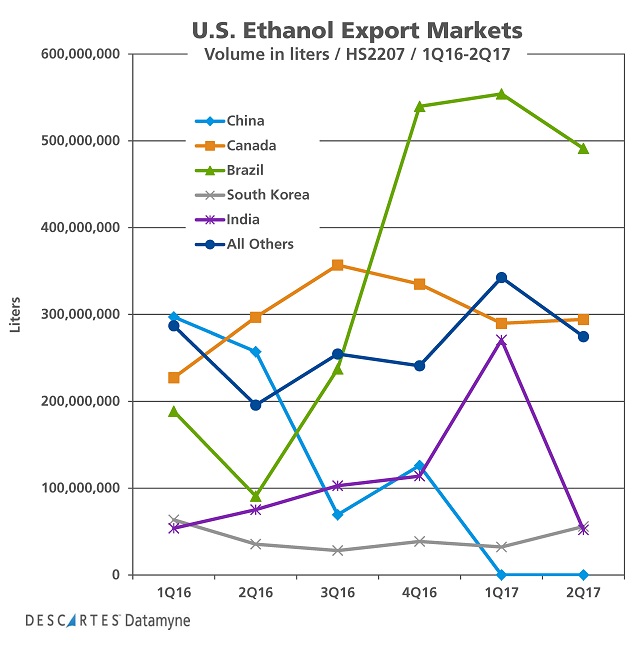

Our data shows U.S. ethanol exports to Brazil reached 959 million liters (253 million gallons) in 2016, with a big spike in fourth-quarter shipments. In the first half of 2017, U.S. ethanol exports edged past one billion liters (272 million gallons).

Brazil’s ethanol producers, led by sugarcane industry association UNICA , sought the protective tariff in response to the recent surge in shipments from the U.S. – captured in this graph:

The graph also shows a deep decline in shipments to China.

A sometime top buyer of U.S. ethanol, China decided late last year to restore its tariff on U.S. ethanol to 30% in 2017, after temporarily lowering it to 5% in 2016.

According to Platt’s, China’s December announcement that it would restore the 30% rate was enough to trigger order cancellations. In another blow to U.S. producers, China also imposed anti-dumping and countervailing duties on U.S. dried distiller grains (DDGs), a byproduct of the ethanol distillation that’s used as animal feed.

U.S. ethanol exports redirected from China likely helped lift exports to Brazil. But what is really fueling the trend, say U.S. industry advocates, is the price of sugar.

U.S. Ethanol Exports Rise…

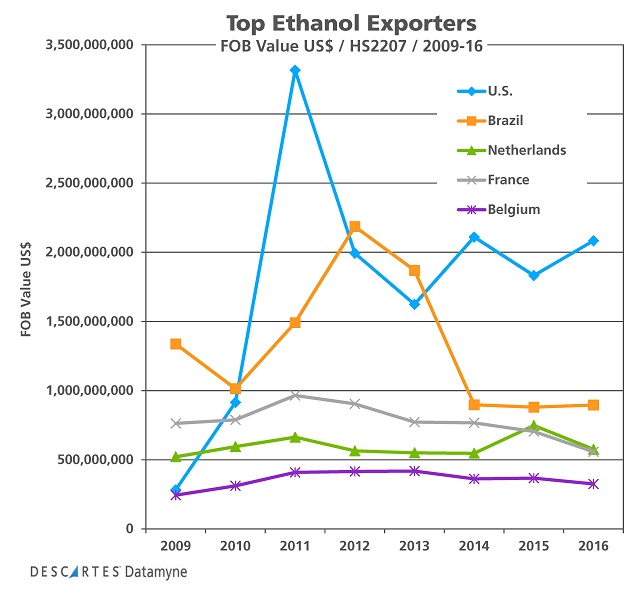

Not so long ago, the U.S. was a net importer of ethanol and Brazil was its top supplier. The relationship changed in 2011 when Brazil ended its 20% tariff on U.S. ethanol, which is produced from corn. At the same time, Brazil continued to export its sugar-fed ethanol to the U.S.

Since then, the two countries have imported from each other. Demand is set by their governments’ renewable fuels mandates. The source of supply fluctuates along with the market prices of the two feedstocks, corn and sugar. Together, the two countries have become the world’s top producers and exporters of ethanol.

From the perspective of the U.S. trade group Renewable Fuels Association (RFA), the spike in exports to Brazil is part of the established pattern. The U.S. product is making up a shortfall in Brazil’s domestic production as Brazilian mills prioritize sugar over ethanol. This is a good thing for Brazilian consumers, who ultimately will be the ones paying for the tariff at the pump.

The RFA has joined Growth Energy and the U.S. Grains Council in asking the Trump administration to take action encouraging Brazil to reconsider the tariff.

They point out that open trade in ethanol between the U.S. and Brazil has been of benefit to both countries. The U.S. is the leading destination for Brazil’s ethanol exports, accounting for 76% of US$358 million in total value in the first half of 2017.

…While U.S. Ethanol Imports Fall

On the other hand, the Brazilian ethanol industry may be rattled by the fall-off in demand from its top market.

While U.S. ethanol imports in 2016 were almost exclusively sugarcane ethanol from Brazil, they declined 60% from the previous year to 36 million gallons, the lowest level since 2010, according to the Energy Information (EIA). Most imported ethanol went to the West Coast. This trade is driven by California’s Low Carbon Fuel Standard Program, which scores sugarcane ethanol as a lower carbon-content fuel than corn ethanol.

UNICA also voiced concern when the U.S. Environmental Protection Agency (EPA) proposed this summer to lessen dependence on Brazilian ethanol in meeting U.S. biofuel mandates, based in part on currently low imports.

Right now, U.S. ethanol production capacity exceeds domestic market demand. The RFA reports that imports have accounted for a fraction of 1% of U.S. ethanol consumption for the last three years. Exports accounted for 6.9% of U.S. ethanol production in 2016, with 40% going to Brazil and China.

Earlier this year, the EIA reported U.S. ethanol was on track for record production and exports in 2017. The new tariffs surely cloud the forecast.

Related:

- Commerce Dept. Imposes Steep Duties on Biodiesel Imports

- Not So Invisible Hand Stirs Ethanol

- Descartes Customs Info™ can help companies keep abreast of duties, taxes and tariffs by delivering this changing content in formats that best mirror their business needs.