Waves of new tariffs lifted U.S. waterborne import peak shipping volumes earlier and higher than ever in 2018, while the promise of more to come pushed an atypical December surge.

U.S. import peak shipping volumes charted a new course in 2018, driven largely by steep new U.S. tariffs imposed or pending on a range of goods, manufacturing imports, and commodities.

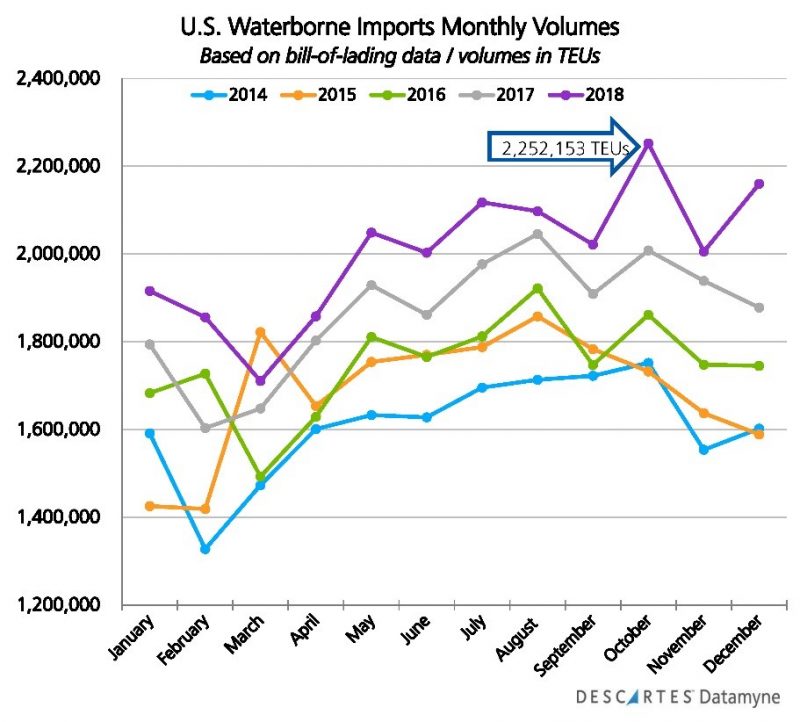

Just a year earlier, maritime imports broke volume records not once but twice, surpassing two million TEUs [20-foot equivalent units] in the first and third months of the traditional August-to-October peak shipping. [See Twin Peaks: Imports Pass 2M TEUs Twice during Import Peak Shipping Season.] In 2018, import volumes crossed the two-million-TEU threshold in May and maintained that volume through the rest of the year.

In another break from the trade patterns laid down in recent years, 2018’s twin peaks occurred in October and December. Traditionally, the peak shipping season for waterborne imports occurs during the August-to-October run-up to year-end holidays as retailers stock up for their peak selling season. In 2015, ’16 and ’17, U.S. import volumes peaked in August – as this chart illustrates:

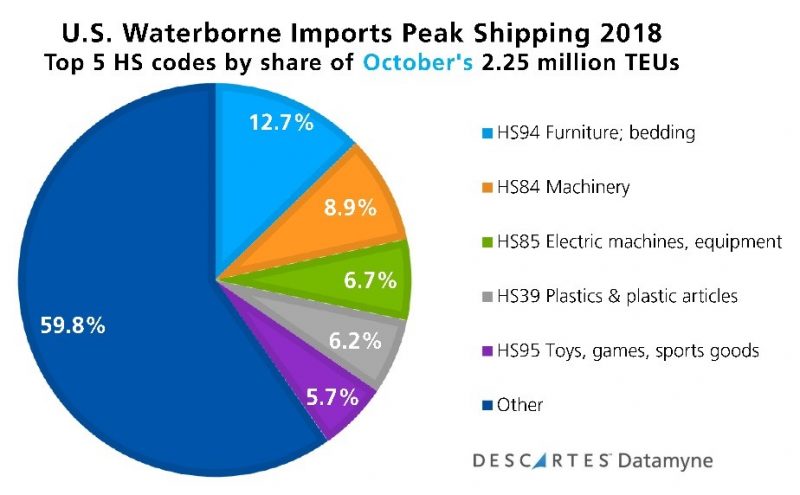

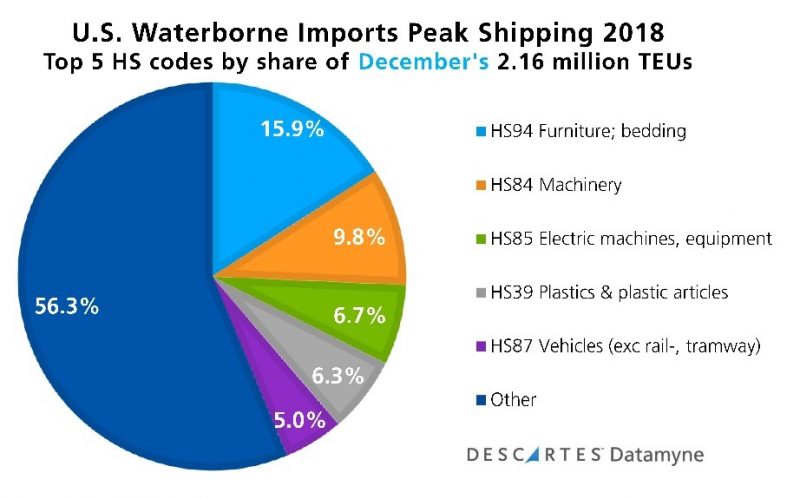

Unpacking bill-of-lading (BoL) data from Descartes DatamyneTM on the top five imports, as identified by two-digit Harmonized System (HS) tariff codes, indicates a similar mix of goods leading high-volume arrivals during each of the U.S. import peak shipping months:

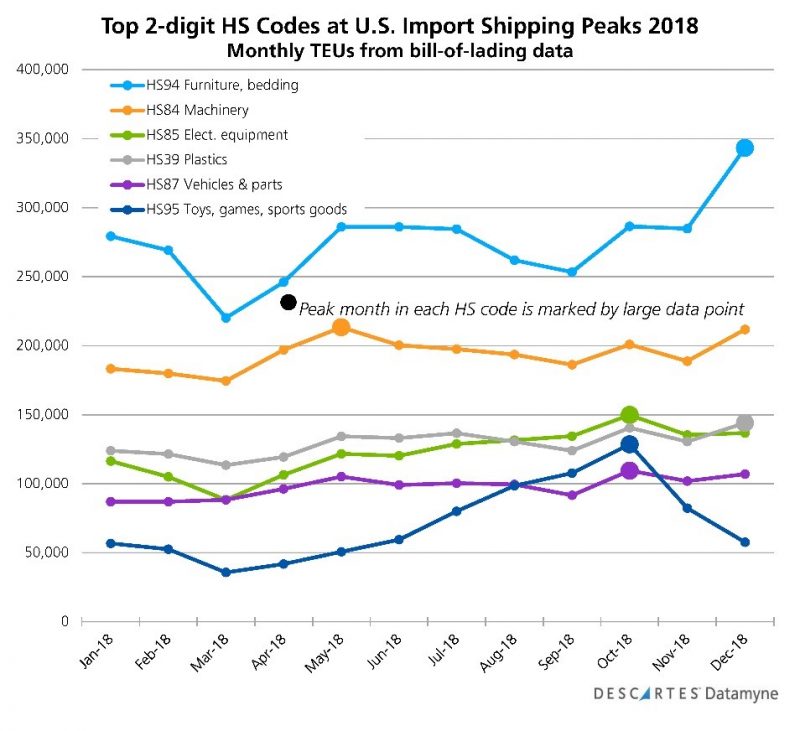

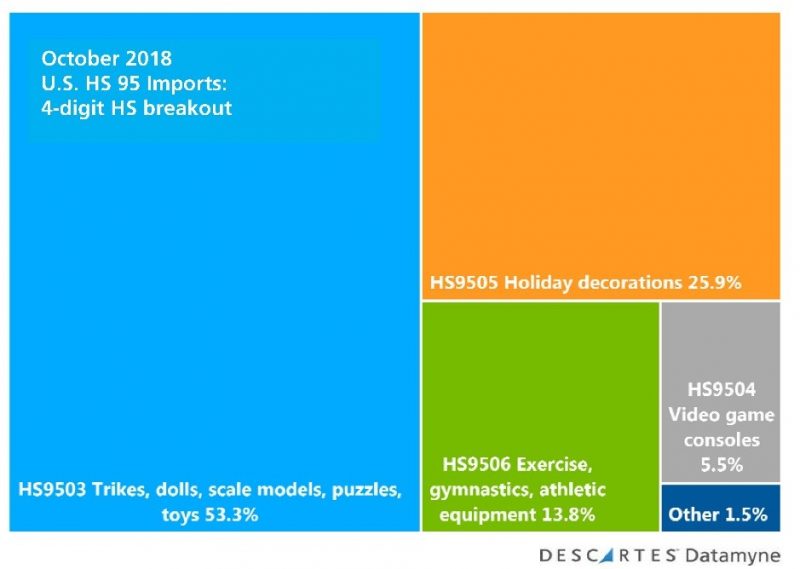

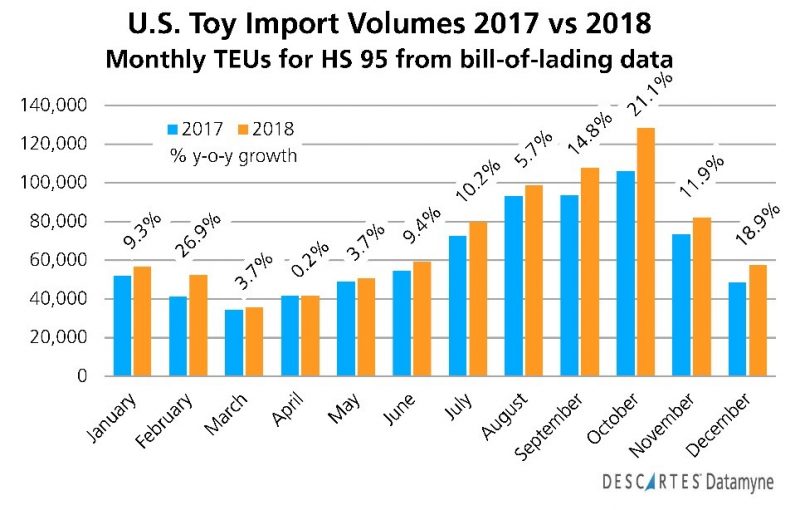

The most obvious difference between the two months is that the traditional seasonal surge in shipments lifted HS95 toys, games and sports gear into the top five in October. In December, the recreational product category fell to ninth place in TEU volume (about where it stays year-long), while HS87 vehicles and parts shifted into the top five. Other high-volume product categories saw atypical gains in December. Even more unusual, both HS94 furniture and HS39 plastics peaked that month, as this chart illustrates:

The end-of-year upturn in imports is widely credited to a rush to increase on-hand inventories prior to the U.S. increasing tariffs on $200 billion worth of Chinese imports. The hike in tariffs to 25% had been scheduled for January 1. On December 8, the U.S. announced a 90-day postponement of the new rates to March 2 [see Truce Called in U.S.-China Trade War].

U.S. Import Peak Shipping: More Unpacking

A new capability of Descartes Datamyne enables users to search and total bill-of-lading records by 2-, 4- or 6-digit HS codes, making it faster and easier to get a clearer picture of what’s inside the container.

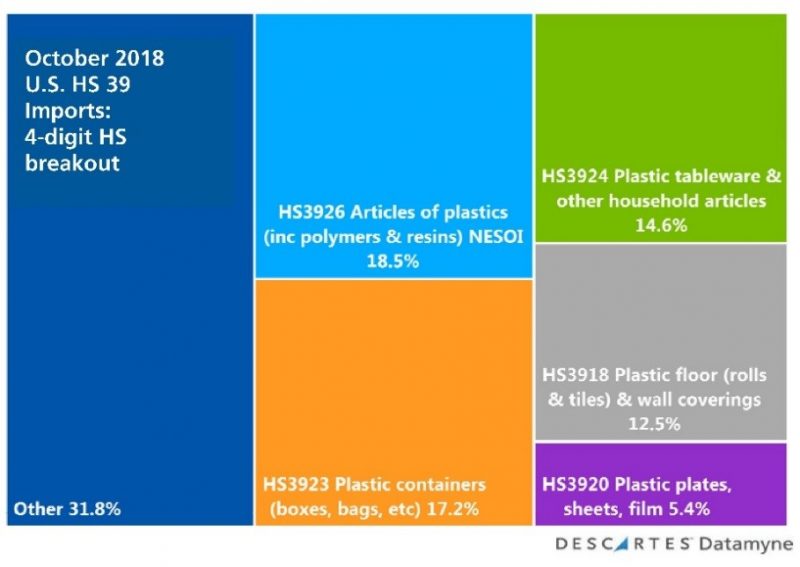

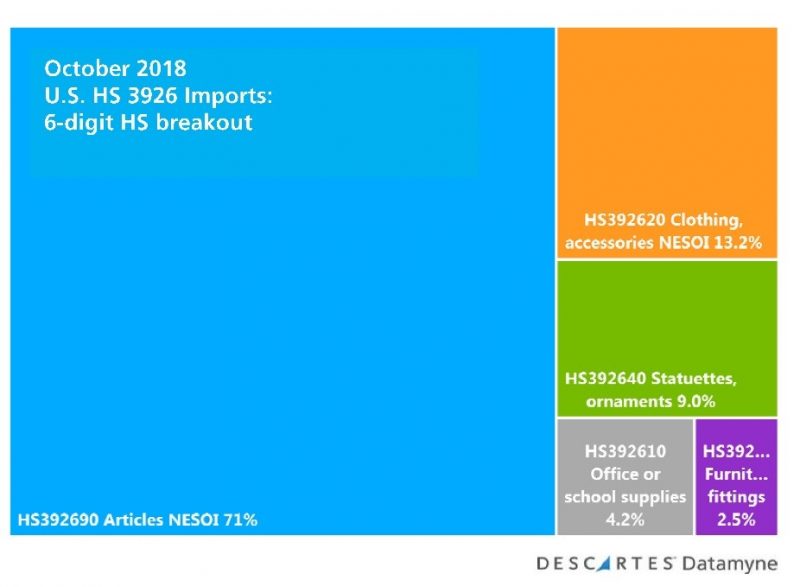

Here, for example, are breakouts of the imported plastics arriving in last year’s peak shipping month of October:

For even greater detail, Descartes Datamyne U.S. maritime import data enables totaling bills by buying or selling companies, as well as drilling down to the commodity descriptions on individual bills.

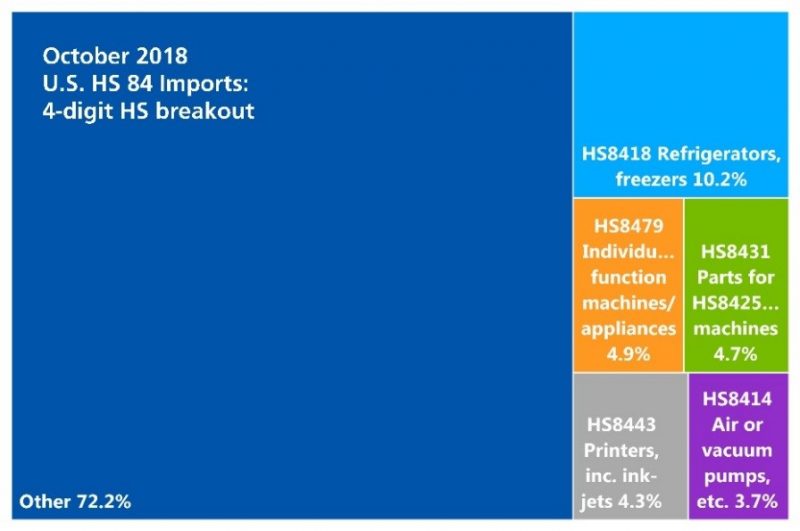

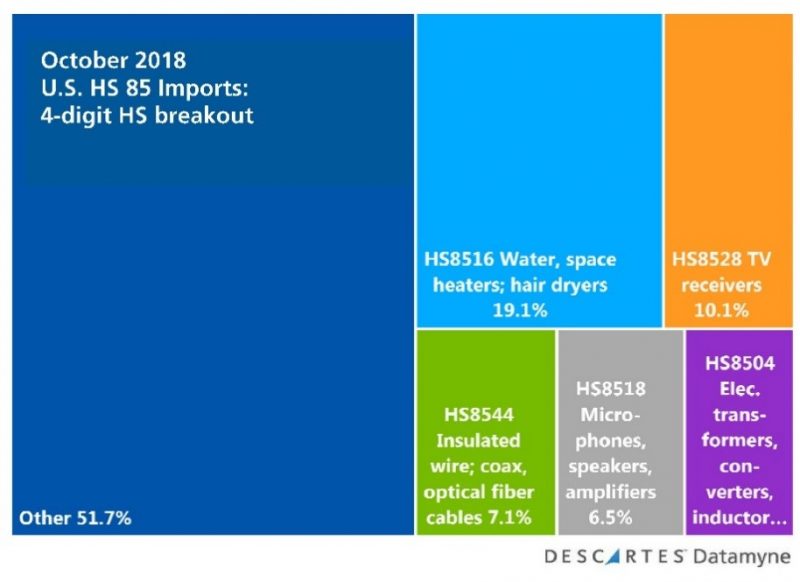

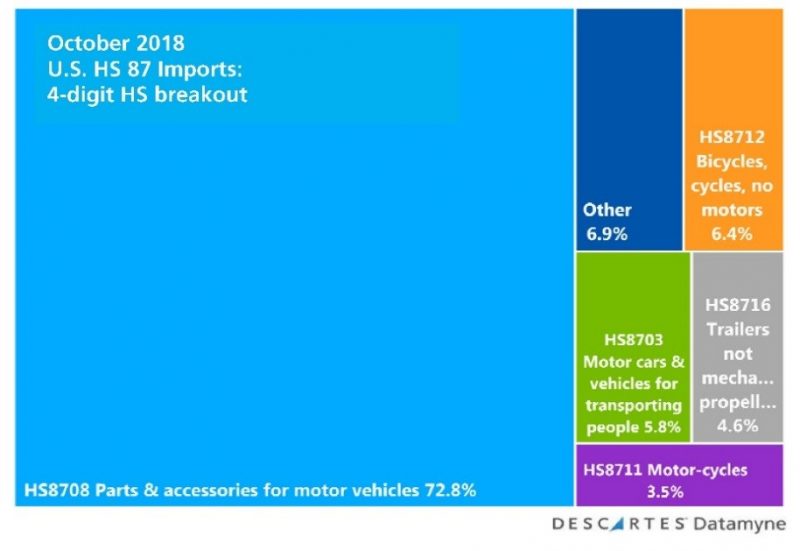

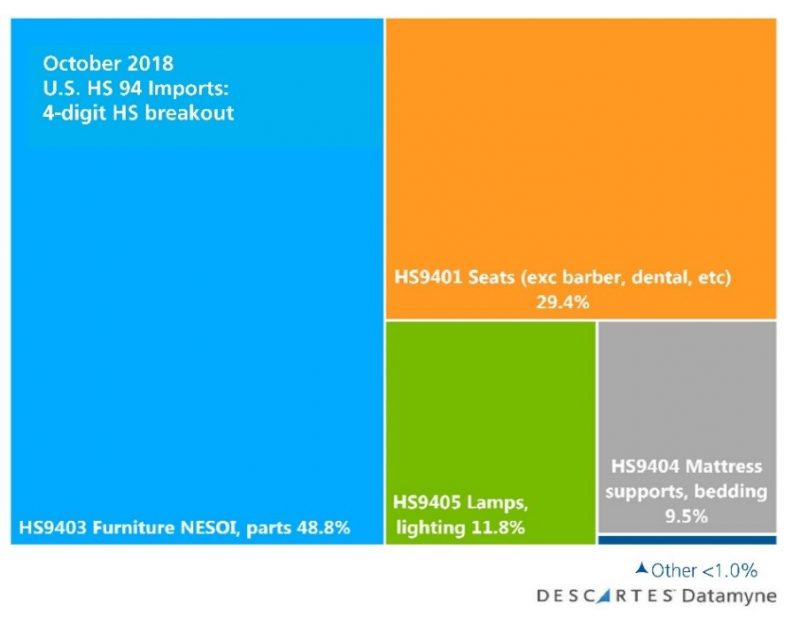

Here are breakouts by four-digit HS code for the rest of October’s highest volume product categories:

As the breakouts illustrate, 2018’s import peak shipping season was dominated by durable goods. Inbound shipments of HS8708 auto parts, to take one example, ran unseasonably high in October, moving up in the volume rankings to No. 3, just behind HS9403 furniture and HS9401 seating.

U.S. Import Peak Shipping: Missing Apparel

As durable goods shipments surged, apparel shipments, a mainstay of U.S. import peak shipping seasons past, have been eclipsed.

In 2017, HS61 apparel ranked fourth, ahead of HS93 toys, and behind perennial leaders HS94 furniture, HS84 machines, and HS85 electric equipment, among peak shipping season product categories.

Despite worries that last year’s demise of a major toy retailer would dent toy imports (although it appears to have negatively impacted state-side sales), HS93 toys retained its fifth-place ranking and posted year-over-year gains in 2018:

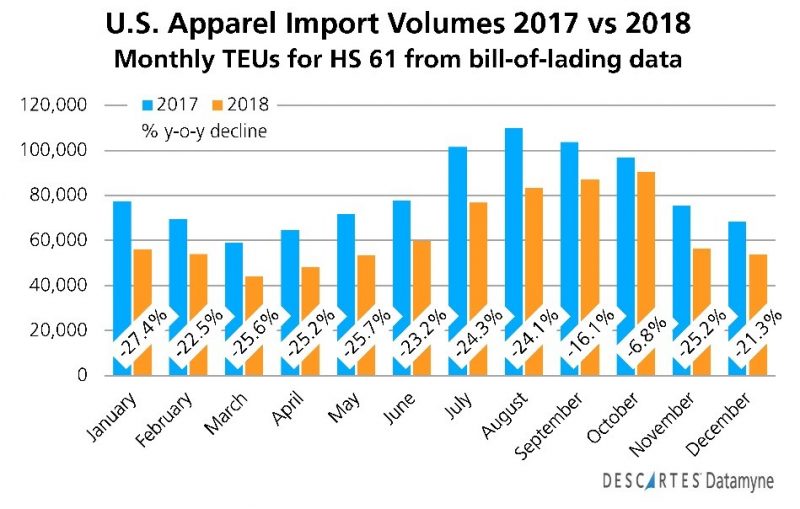

In contrast, apparel imports were down, not just in peak-month October, but throughout 2018, as the next chart shows:

Contemplating on the recent release by the Commerce Department’s Office of Textiles and Apparel (OTEXA) of November import data indicating the drop in imports, just-style comments that the decline may reflect retailers’ stock-piling product earlier in the year.

The maritime data, however (charted above), captures apparel imports from top countries of origin China, Vietnam, Bangladesh, and other rising Asian producers. This data yields little evidence of ramped-up orders at any time during the year.

Related: