As investors bet on the future of gasoline fueled automobiles, palladium trade is on the rise, and with it the price of this precious metal.

The price of palladium has surged 39% so far this year, making it the leading contender for the title of best performing industrial metal – indeed, best performing commodity – of 2017.

Palladium achieved price parity with its more glamorous relation platinum on September 27. Since then, palladium prices have edged past platinum. (You can track the platinum-palladium ratio here at the Denver Gold Group’s website.)

Both platinum and palladium are precious metals – although platinum is much more likely to turn up on your wrist as a bracelet, while palladium is mostly used for industrial applications. Both are used to make catalytic converters for automobiles. Most important, both are vehicles for investment.

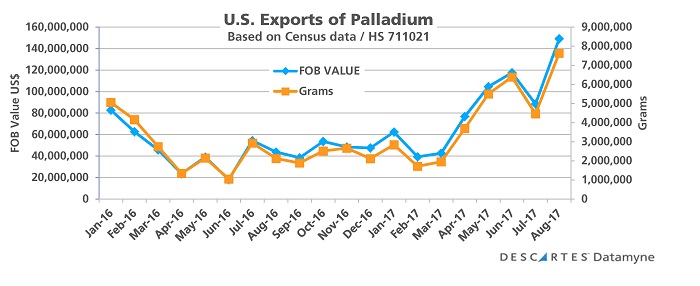

Palladium’s rising price is directly tied to investors’ confidence in rising global demand for cars that run at least partly on gasoline. It’s driving up U.S. trade in the metal. Through the first eight months of 2017, U.S. platinum imports increased 34.6% by value, while exports rose 62.8% compared with the same period a year ago.

We highlighted August’s spike in exports, a 241% increase over August 2016, in our monthly metals and minerals ranking report (currently available for downloading from our free report library).

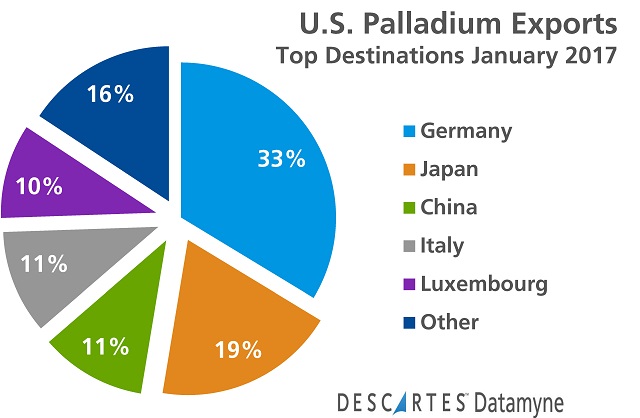

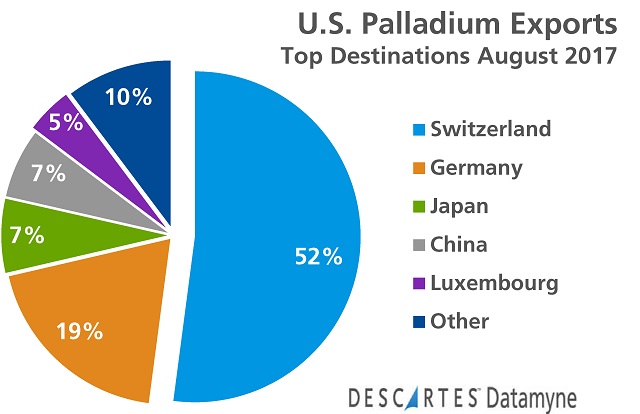

The trade data also provides an indicator that investors are elbowing manufacturers aside in the market for palladium. Compare the top markets for U.S. palladium exports in January with market share in August. Industrial Germany was the leading destination for U.S. palladium at the beginning of the year. Eight months on, more than half of exports were bound for Switzerland, a major trading, vaulting and refining center for precious metals.

Related:

- Our monthly ranking reports cover each month’s value in trade of the top 25 U.S. imports and exports overall as well as the top 25 imports and exports within the categories of agricultural products, chemicals, electronics, and metals/minerals. Year-over-year comparisons of trade values for the month of the report as well as the cumulative values of trade through the proceeding months are provided. Recently expanded to include highlights and analysis (such as the surge in palladium trade), the latest ranking reports are available for downloading from our free report library.