The U.S. is due to swing back to a net exporter of energy in four years, with some help from increasing domestic consumption of renewable energy. But what about overall U.S. renewable energy trends? Early indicators reveal mixed results.

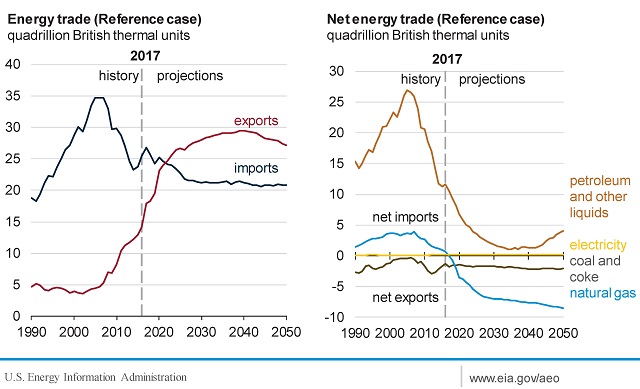

In February, the U.S. Energy Information Administration (EIA) moved up its ETA for the U.S. return to net energy exporter to 2022. Renewable energy trends indicate that just a year earlier, the EIA projected 2030 as the year the U.S. would once again export more energy than it imports – something it hasn’t done since 1953.

The EIA projection assumes today’s trends will continue on the same trajectories: rising natural gas production, driven by the shale revolution, and steady demand for coal abroad will keep fueling U.S. export growth. Decreases in domestic energy consumption will also contribute, though less so, to the shift in the U.S. energy trade balance by decreasing the need for fossil fuel imports.

Here is a summary of what the EIA see ahead for U.S. energy imports and exports:

The EIA focus here is on trade in fossil fueled energy (the U.S. does a negligible trade in electricity).

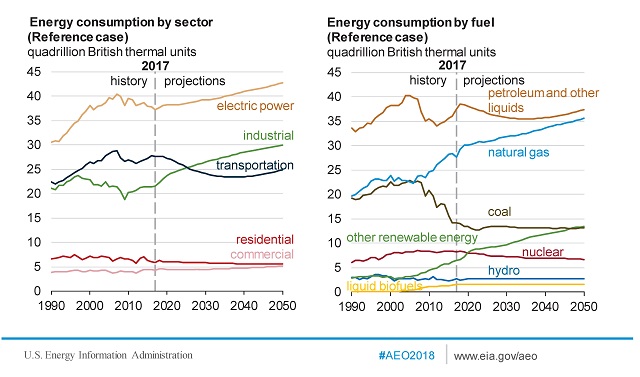

The EIA projection does factor in renewable energy, but only to the extent that it reduces U.S. consumption and, as a result, imports of petroleum. Indeed, the EIA expects renewables to claim a growing share of U.S. energy consumption – especially solar and wind energy, the “other renewable energy” in this projection on U.S. energy consumption by sector and by fuel through 2050:

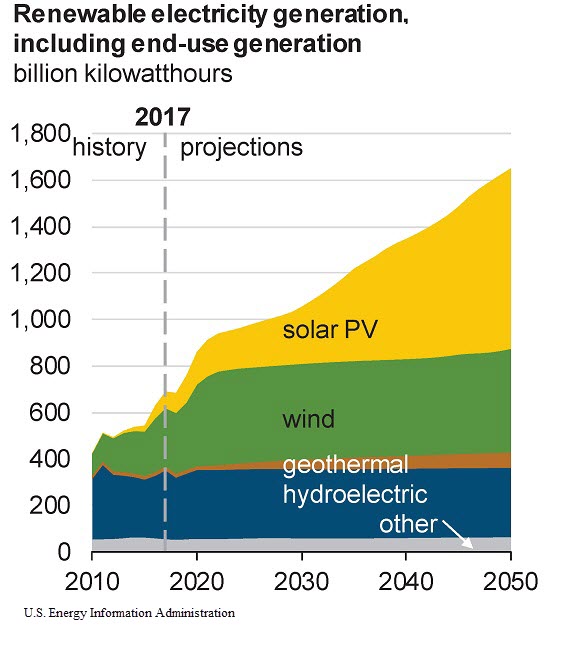

Here’s a closer look at how the EIA sees the mix of renewables fueling electricity generation through 2050:

U.S. Renewable Energy Trade by the (HS) Numbers

They may not figure directly in the EIA energy trade balance projections, but renewables are creating new avenues for U.S. trade in both directions. Measuring U.S. renewable energy trade flows presents some challenges, however.

For a start, sunshine, wind and the earth’s heat can’t be imported or exported. But the components for systems that generate and store energy from these sources can be shipped across borders. These shipments generate customs documents, bills of lading and, ultimately, trade data that can yield indicators of import-export values and volumes.

A further challenge: The Harmonized System (HS) of tariff codes that are the product identifiers in trade data were originally developed as a classification tool for Customs authorities to apply their countries’ import duties.

That means distinct HS codes may not yet be assigned to products because they have not traded in sufficient quantity or have not been subject to distinct tariff treatment.

Mindful of the importance of HS codes in global information gathering, the overseer of the Harmonized System, the World Customs Organization (WCO), is working to expand its identification system to track trade in products that are the targets or tools of global policy initiatives, including climate mitigation.

So, for instance, the WCO introduced a code for lithium-ion batteries (HS850760) in 2012. The U.S. followed up in 2015 with new 10-digit HTS codes to distinguish between Li-ion batteries for electric vehicles (HS8507600010) and batteries for consumer devices and power tools (HS8507600020).

There are tariff codes for wind-powered electric generating sets (HS8502310000), alternators for those sets (HS8501640021), and wind turbine blades and hubs (HS8412909081). However, no code distinguishes the steel towers that support wind turbines from other, similar structures of steel (all could be classified, for example, under HS730890).

U.S. Renewable Energy Trade: Powered by the Sun

Solar energy systems consist of photovoltaic cells assembled in modules or panels. Both the cells and the assembled modules are identified by HS codes.

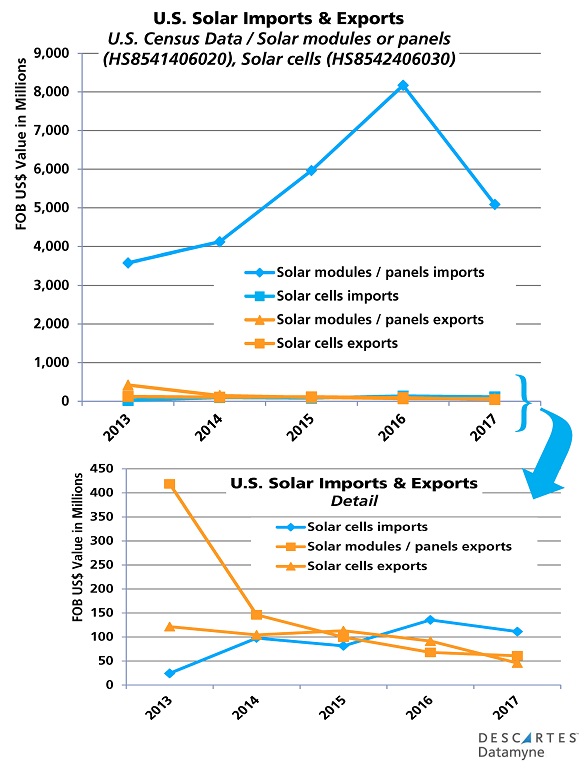

Our trade data (summarized in the following chart) indicates that the U.S., a net exporter of photovoltaic cells used in solar panels in 2015, has been a net importer of PV cells since 2016. The U.S. has been a net importer of solar panels since 2008.

In 2011, the U.S. domestic industry sought regulatory relief from a surge in imports. The resulting steep duties (from 30% to 250%) imposed in December 2012 slowed but did not reverse the growth in imports. Panel makers next petitioned to close a loophole that exempted Chinese solar modules from the punitive tariffs as long as they were assembled from non-Chinese PV cells. Imports continued to climb – although their countries of origin shifted, with Malaysia overtaking China as the top source in 2016.

This January, the U.S. imposed Section 201 tariffs on solar imports – authorized under Section 201 of the Trade Act of 1974 to “safeguard” a U.S. domestic industry.

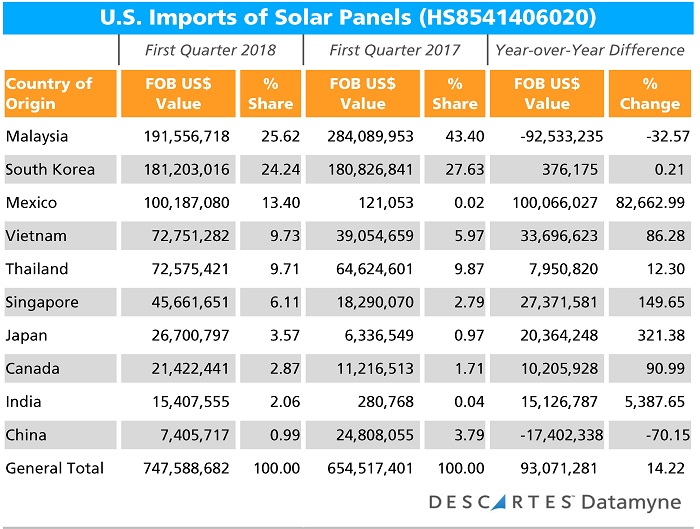

Our first-quarter data shows solar panel imports are still on the rise, but with big losses among erstwhile leaders and startling gains for countries that claimed modest shares of the U.S. market until now. Here’s the first-quarter year-over-year comparison:

The sharp shifts may be due in part to January’s protective tariffs. But how to explain the steep increase in imports from Mexico, which are subject to the new tariff?

U.S. Renewable Energy Trade: Powered by the Wind

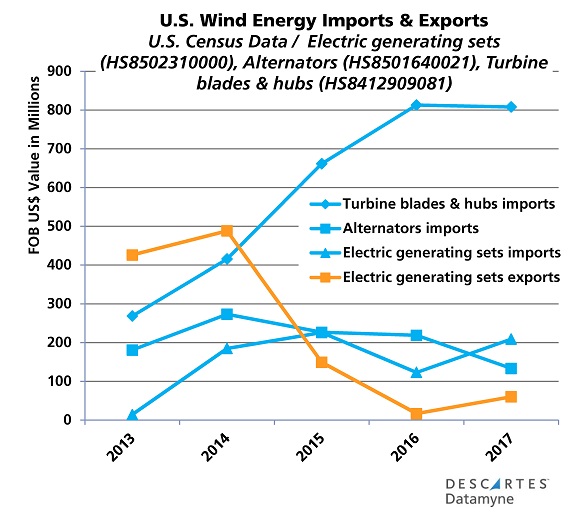

In comparison to solar, U.S. import-export trade in wind energy products is on a modest scale. But, again, U.S. trade in wind system products we can identify by HS code is predominately inbound. In fact, the data shows no exports at all for wind-powered alternators or turbine blades and hubs, as the chart illustrates:

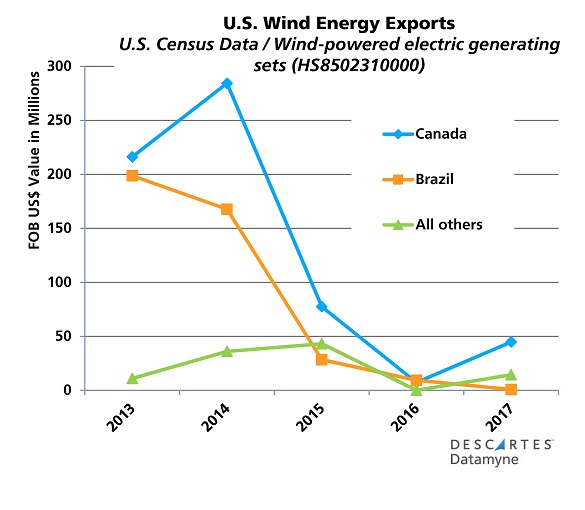

Five years ago, U.S. exports of wind-powered electric generating set were on an upward trajectory. In assessing the opportunity for U.S. exporters of wind energy products, the International Trade Administration saw two competitive challenges emerging in key market Latin America: Chinese manufacturers previously focused on outfitting domestic projects were poised to compete directly with U.S. firms. Meanwhile, Brazil, one of two principal markets for the U.S. product, was deploying local content requirements and high import tariffs to grow its domestic manufacturing base. The data shows the result:

Our first-quarter 2018 data indicates U.S. exports are down 50% compared with the first three months of 2017, with Canada accounting for 65.7% and Mexico 18.2% of shipments by value.

Global commissioning of onshore wind turbines slumped 12% in 2017, according to Bloomberg, but is expected to bounce back 17% in 2018. However, Bloomberg foresees little change in the line-up of top four manufacturers, supplying more than half of the turbines in the global market, with only one (General Electric) based in the U.S.

U.S. Renewable Energy Trade: Lithium Storage

The sun doesn’t always shine, nor the wind blow. Renewables wouldn’t be practical without a system for storing the energy they generate for later use.

Lithium-ion batteries have dominated deployment of energy storage to accompany renewables from the start. The falling cost of Li-ion batteries looks likely to make the renewables-plus-storage combination a cost-competitive option for distributing energy, reports Bloomberg.

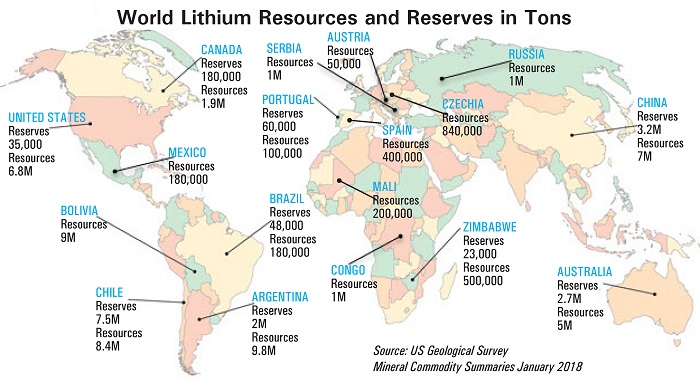

Our blog has tracked trade in lithium, the main ingredient in Li-ion batteries, for some time, drawing on data back through 2007. The U.S. is rich in lithium resources, reckoned at 6.8 million tons, as the map summarizing the latest U.S. Geological Survey shows:

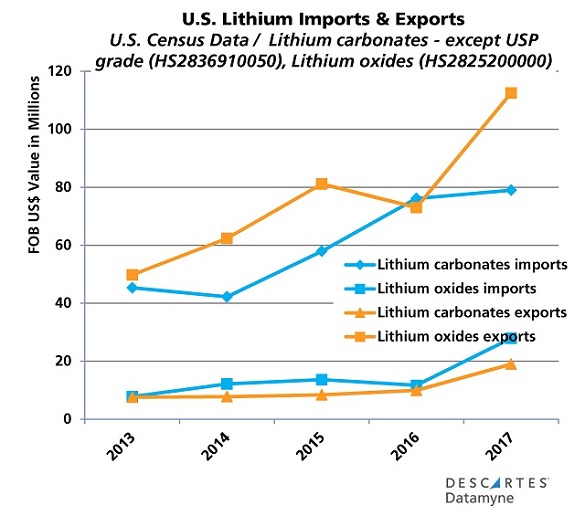

Nonetheless, the U.S. is a net importer of lithium carbonates, the first chemical in the lithium production chain. On the other hand, U.S. exports of lithium oxides outstripped imports of carbonates and oxides combined in 2017, as the following chart shows:

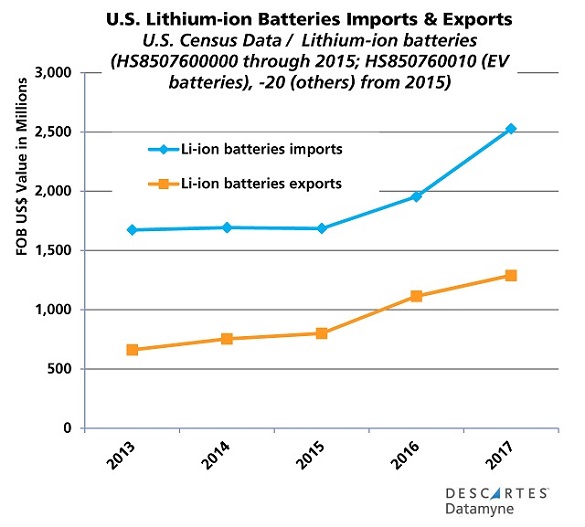

The U.S. is a net importer of Li-ion batteries, as the next chart shows:

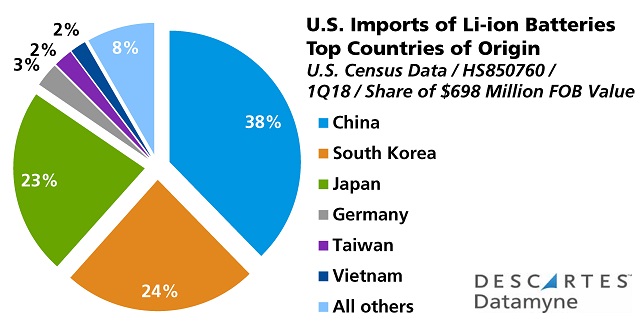

The U.S. relies on China for its imported Li-ion batteries, as this chart illustrates:

A measure of that reliance: In drawing up its list of proposed protective tariffs on imports from China, the U.S. chose to target nickel cadmium batteries instead of Li-ion batteries. Nickel-cads account for 2.3% of storage battery imports from China compared with 62% for Li-ion batteries, accounting for 62% of this trade. A tariff on lithium ion (Li-ion) batteries might hurt China’s exports more – but would also exact a bigger toll on downstream users in the U.S.

U.S. reliance on China for storage batteries is likely to continue. According to the Financial Times, 84% of Li-ion mass production will be located in China or the U.S. by 2020, with China projected to have the capacity to produce 121 gigawatt hours (GWh), compared with U.S. production of 38 GWh.

Taken together, the balance of U.S. renewable energy trade – at least in these products: solar panels, cells, wind powered system components, lithium, and Li-ion batteries – tilted toward imports in 2017, adding $7.4 billion to the U.S. deficit. For now, at least, the contribution of renewables to U.S. energy trade balance primarily will be to dial back domestic demand for imported fossil fuels.

Related:

From our blog:

- U.S., China Trade Tariffs

- U.S. Deploys Protective Tariffs on Solar Panels, Washing Machines

- HS Tariff Codes for Tesla Products

- A New HS Code for EV Makers

From our trade content solutions:

- Descartes CustomsInfo™ Manager helps clients minimize trade barriers with a vast database of regulations, rulings, duties, and more. Learn more.

- Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. import trade in renewables – including consignees, shippers, and notify parties, cargo values and volumes. Ask for a demo.