New Zealand has a clear shot at its target of $2 billion in wine exports by 2020, reports the New Zealand Winegrowers industry association, with New Zealand wine gaining U.S. market share, surpassing $500 million for the first time in April.

Last year, New Zealand vintners edged out Australia’s for the first time in value of shipments bound for the States. New Zealand vintners’ growth strategy has been to compete in pricier premium categories. At the same time, wine imports are trending up-market in the U.S., which still buys more wine by volume from Australia.

A similar dynamic is at work in U.S. distilled spirits exports. Bourbon, the perennial top U.S. export ranked by volume and value, recently ceded first ranking by value of exports to premium brandy in 2016. [See Whiskies Top Tipple in U.S. Trade in Distilled Spirits.]

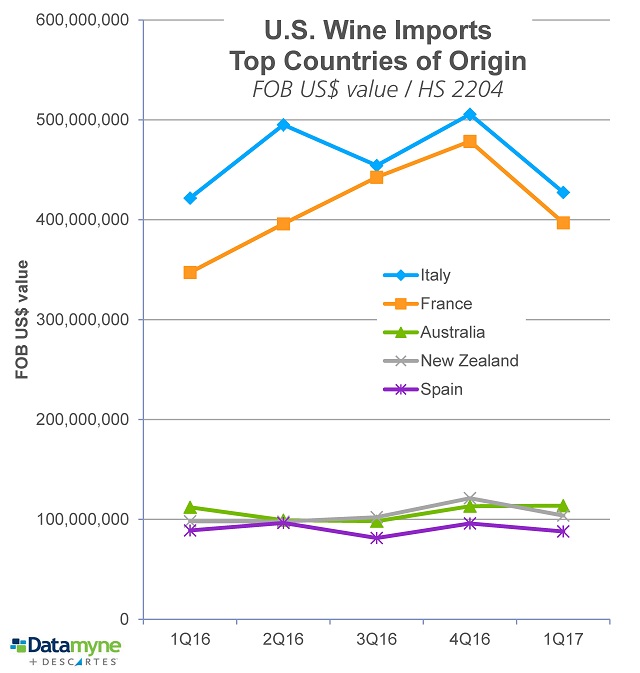

Our trade data captures the seesawing competition between New Zealand and Australia in the U.S. imported wine market:

Note that Rabobank reported a revival in Australian wine prices in fourth-quarter 2016. This may underlie Australia’s lead over New Zealand in first-quarter 2017 FOB US$ value of U.S. wine imports.

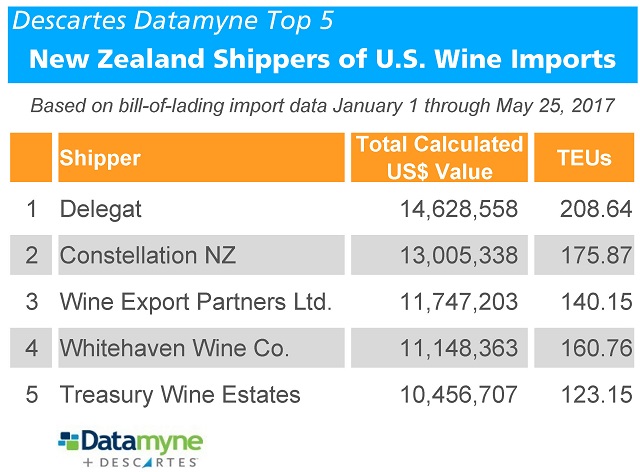

Our bill-of-lading U.S. import data yields market intelligence on the parties to this trade, including carriers, importers and, as shown here, shippers of wine imports from New Zealand:

To see more data tracking New Zealand wine gaining U.S. market share – including the bill-of-lading on shipments arriving in U.S. ports as recently as yesterday – just ask us.

Related:

From our blog:

- Wine Retailers to Feel Little Pain from Hanjin – Wine Industry Insights

- Bubbly on the Rise: US Imports of Sparkling Wine Are Up

- Not Just for Bastille Day: US Toasts French Wine & Spirits

- Datamyne Top 5: Markets for Argentina’s Wine

From our Free Report Library: