Could the Pacific Alliance become the vehicle for the economic ties across the Pacific Rim that were the aim of the Trans-Pacific Partnership (TPP)?

The four members of the trade bloc – Chile, Colombia, Mexico and Peru – are among Latin America’s leading advocates for free trade and the region’s more robust economies. Many observers see a connection between the trade policy and the economic performance – including Argentine President Mauricio Macri and Brazilian President Michel Temer, who say they want to steer the Mercosur trade bloc in which their countries are members toward more open markets and relations with the Alliance [see Actively Seeking Trade Ties].

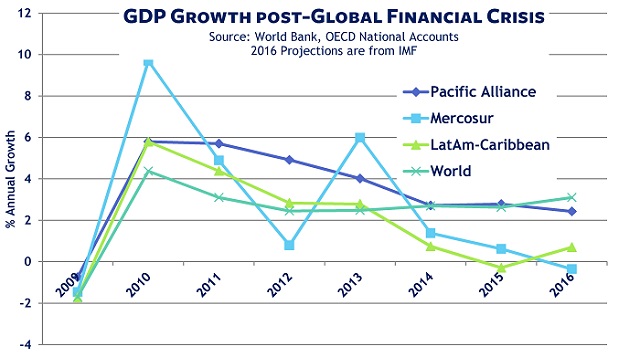

Indeed, our trade data shows that while both blocs continued to see a downturn in trade last year, the loss was lower for the Pacific Alliance as a whole, with exports off -3.6% and imports -7.3%*, than for Mercosur, with exports -10.8% and imports -13.4%. Meanwhile, the Pacific Alliance has been able to maintain positive economic growth, ahead of Mercosur and the region.

Last week, Mercosur and Pacific Alliance foreign ministers met in Buenos Aires to discuss trade, economic cooperation and eventual pan-South American alliance. (What to do about Mercosur member Venezuela, a potential sticking point, will be left to the OAS, according to this report from Mercopress.)

Pacific Alliance expansion: new path to membership

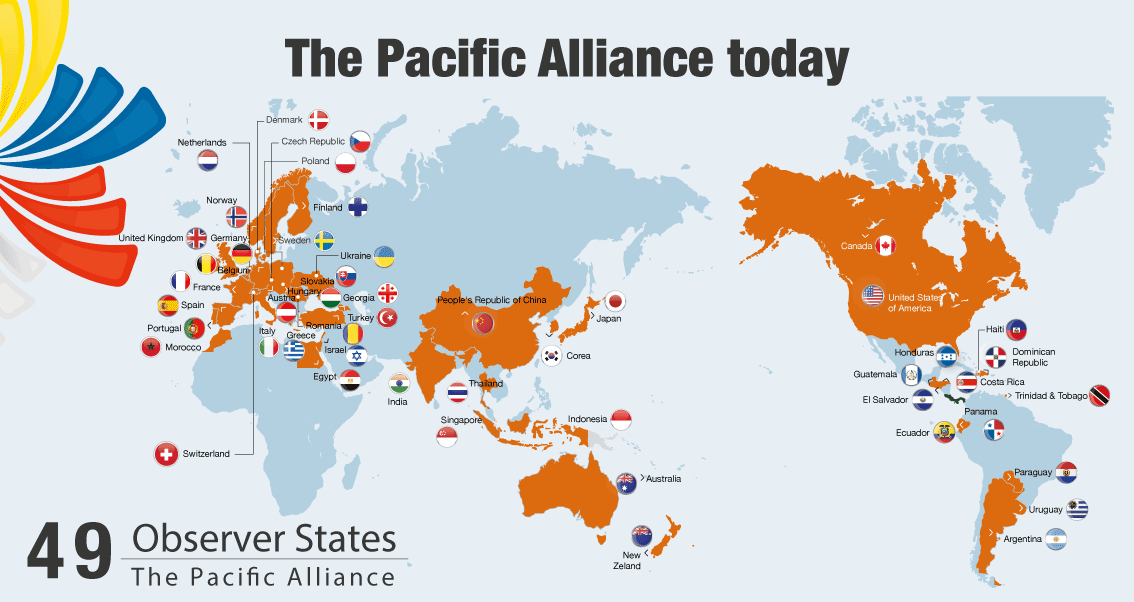

Pacific Alliance expansion plans call for a new “associate” level of membership – and, reports Bloomberg, New Zealand is aiming to become the Alliance’s first trans-Pacific associate. Other candidates for this “stepping stone” to full membership are Canada and Australia.

The Alliance already admits “observer countries” that subscribe to the trade bloc’s free trade principles and objectives. Observers may participate in Alliance meetings, where they may speak but cannot cast a vote. They may request to be candidates for full membership if they have free trade agreements with at least half the members. Two observers fill the bill and are considered candidates to be members: Costa Rica and Panama.

Last year, Argentina was granted observer status by the Alliance, joining fellow Mercosur members Paraguay and Uruguay – another sign that the two trade blocs are drawer nearer.

Pacific Alliance expansion: looking to Asia

The Pacific Alliance was founded in 2012 with the express purpose of becoming a hub for trade between Latin America and Asia. It counts among its observer states China, India, Indonesia, Japan, Korea, Singapore, and Thailand.

Last year, the Alliance and the Association of Southeast Asian Nations officially subscribed to the ASEAN-Pacific Alliance Framework for Cooperation. As this analysis in The Diplomat notes, the framework is the first of its kind between an East Asian and a Latin American regional organization.

This March, Pacific Alliance president pro tempore Chile hosted a meeting of TPP signatories, plus China and South Korea, to discuss ways to achieve the aims of the Pacific Rim trade pact. The likely way forward, according to this report from Reuters, is to build on existing agreements such as the Pacific Alliance.

Note that an alternative vehicle, the proposed Regional Comprehensive Economic Partnership (RCEP), has strong support from Asia. Paulina Nazal, speaking for the Ministry of Foreign Affairs of Chile, cautioned that the meeting was just a beginning of an open-ended discussion of options. Still, it’s clear that the Pacific Alliance is positioned to play a pivotal role in shaping trans-Pacific trade.

*Note: The Pacific Alliance decline in imports in 2016 was revised to -7.3% (from the originally published -5.4%) April 11, 2017 -Editor

Related:

- Download our free report Quick Look @ Pacific Alliance Trade in 2016 for stats on each member’s top imports and exports, top markets and countries of origin, and top regional trade partners, based on our Latin American trade data.

- Also see our free report Quick Look @ Mercosur Trade in 2016

- From our blog: Actively Seeking Trade Ties: Mercosur

- Learn more about our Latin American import-export data.