Mexico, steadily rising in rank to No. 12 among exporting nations, has eclipsed China and Canada to become the U.S.’s leading trade partner.

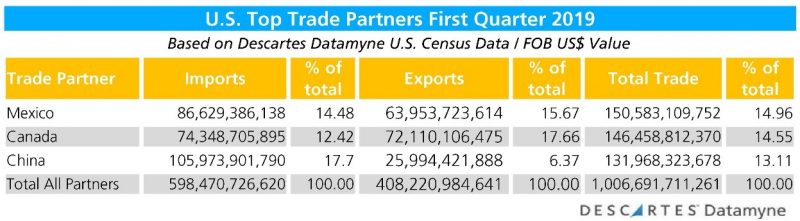

Mexico is now the top U.S. trade partner, ranked by total value of import and export trade, according to Descartes Datamyne’s U.S. Census data for January through March 2019, as summarized in this table:

Perennial top U.S. trade partner China has fallen to third place behind the U.S.’s fellow members in the North American Free Trade Agreement (NAFTA). This stunning change in trade relations is largely (but not solely) the result of the U.S.-China trade war, which has just flared up again. After calling at truce last December, the U.S. on May 10 went ahead with a pending boost in tariffs from 10% to 25% on $200 billion in Chinese goods. China quickly countered with retaliatory tariffs.

But there is more at work here than the damage done by the trade war. The latest ranking confirms a second, long-building trend: Mexico’s steady rise as an exporter.

Mexico is now among the world’s top dozen exporting nations, ranked by value of trade in 2018, moving past North American trading partner Canada, Russia and Singapore in the last five years. As the 5-year trade data from UNCTAD (summarized in the table) shows, Mexico’s rise in the rankings is the result of gains in export sales as the UK, Russia, Canada and Belgium saw exports decline.

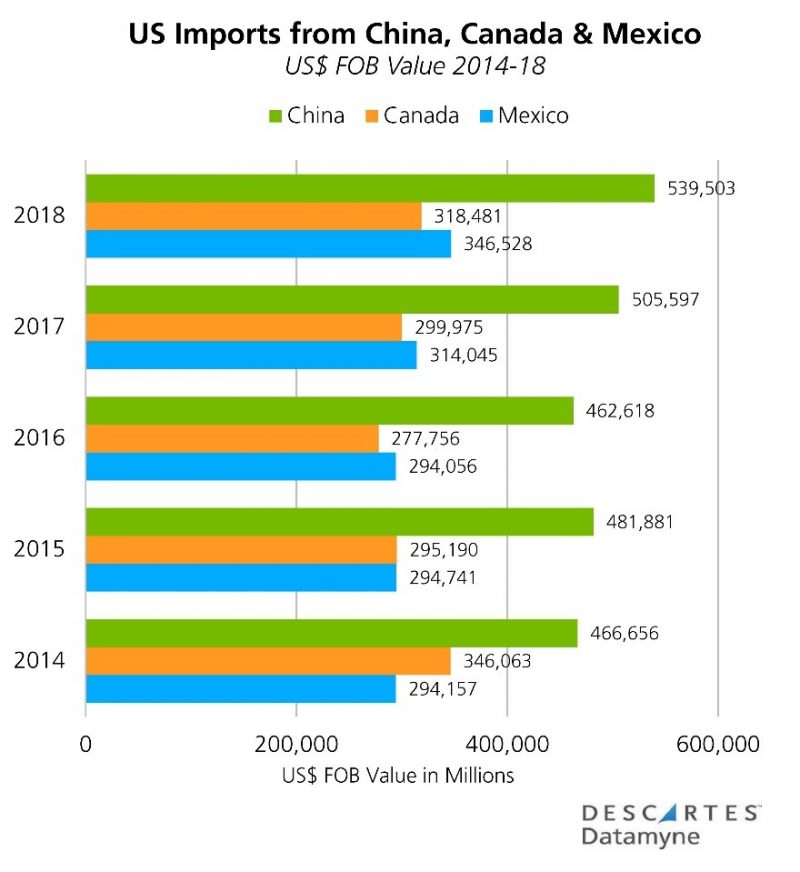

Mexico achieved near parity with Canada as country of origin for U.S. imports in 2015, and has led Canada since 2016, as the graph illustrates:

Top U.S. Trade Partner: Mexico’s Exports Driven by Oil and Automobiles

A closer look at Descartes Datamyne’s Mexican trade data reveals that Mexico has capitalized on its NAFTA-defined partnership with the U.S. to build exports. Over the last five years, about 80% of Mexican exports have shipped to U.S. markets. Only in 2018 has the U.S. share slipped to 76%.

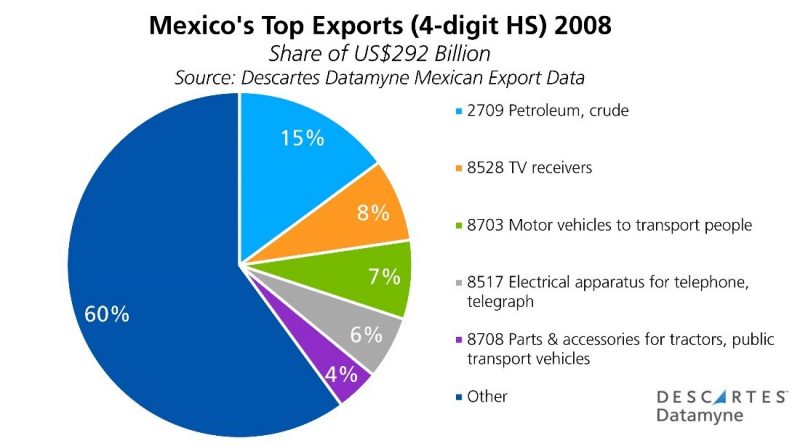

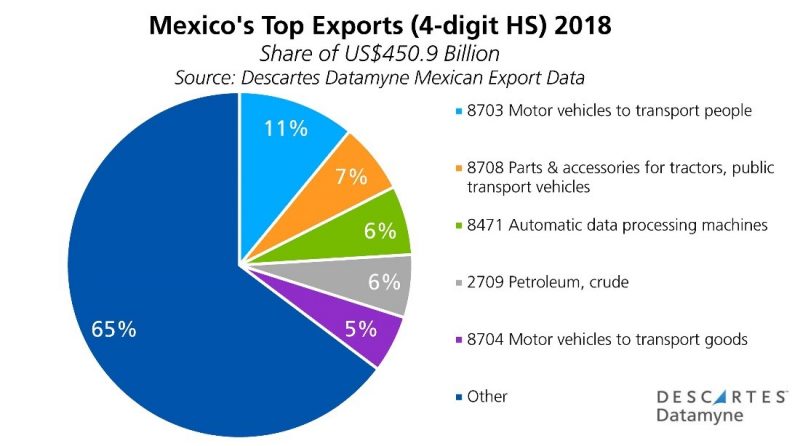

The Mexican data also makes clear that petroleum and motor vehicles are the drivers of its export trade. The shale revolution and resulting declines in demand and in oil prices have whittled petroleum’s share of this trade. These pie charts show Mexico’s lessening dependence on petroleum as an export, while passenger vehicles, trucks and automotive parts have gained.

By comparison, Descartes Datamyne Canadian trade data indicates petroleum has continued to command a leading share of Canadian exports — 18.6% in 2014 and 14.9% in 2018 – accounting for much of the recent lag in Canada’s exports as Mexico’s have advanced.

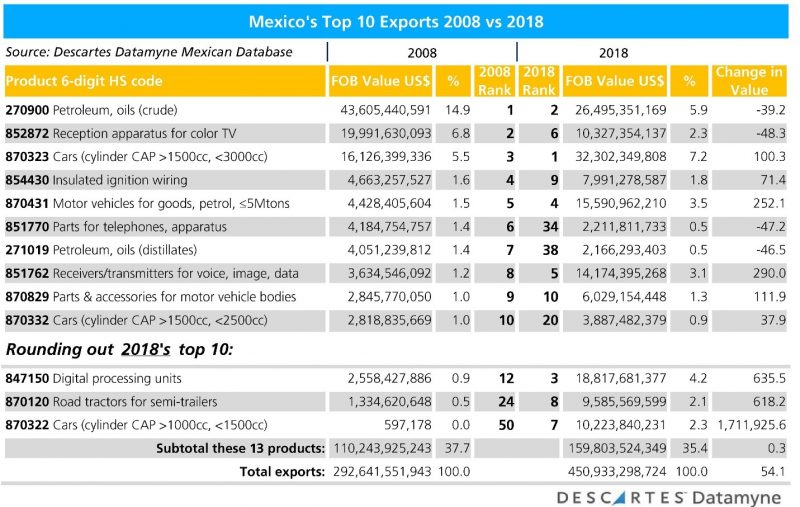

Here’s a more detailed look at Mexico’s top 10 exports at the 6-digit HS code level in 2008 compared with 2018:

Leading losses among Mexico’s exports to the U.S. over the last decade were color TVs (-48.3%), parts for telecoms (-47.2%), petroleum products (-46.5%), and crude oil (-39.2%). The most spectacular gain – 1.7 million% – was posted by cars with an engine cylinder capacity of 1000cc to 1500cc – a.k.a., a 1.0- to 1.5-liter engine – moving up in rank from No. 50 in 2008 to No. 7 in 2018. Other motor vehicles made triple-digit gains. Exports of electronics products also increased significantly, led by digital processing units (up 635.5%) and “receivers/transmitters for voice, image, data,” a product category that includes modems, (290%).

Top U.S. Trade Partner: USMCA Rewrites the Rules on Auto Exports

Given the role of motor vehicles in North American trade, it’s no surprise that some of the biggest changes in the renegotiated NAFTA – designated the U.S.-Mexico-Canada Agreement, or USMCA – center on automobiles:

- USMCA country of origin rules require that 75% of the components assembled in automobiles must be made in Mexico, the US, or Canada to qualify the finished product for duty-free trade in North America. NAFTA sets the bar at 62.5%.

- USMCA labor provisions require that 40% to 45% of automobile parts will by 2023 be made by workers earning a minimum of $16 an hour by 2023.

The USMCA would also open Canada’s dairy market to more U.S. products. Along with autos and auto parts, these product-focused policy changes were top priorities for the Trump administration. (See NAFTA Negotiations: Sticking Points.)

Among other changes sought by the U.S., USMCA includes provisions for review of the trade pact every six years, and a 16-year sunset clause. The new trade pact does not include the protections against U.S. Section 232 tariffs that Mexico and Canada wanted. Their steel and aluminum exports have been subject to tariffs since last June. (See Tariff Changes Take Center Stage.) However, the trade-off for agreeing to USMCA’s labor and country of origin rules for automobiles is protection against Section 232 tariffs for motor vehicles from Mexico and Canada. (On May 17, the U.S. postponed its pending decision imposing Section 232 tariffs on automobiles and automobile parts for 180 days.)

A working paper from the International Monetary Fund forecasts a contraction in production of motor vehicles and vehicles parts for all three USMCA partners resulting from the USMCA provisions’ added overhead passed on in higher prices for consumers. For Mexican auto manufacturers, the contraction in output is projected to exceed 5%. Vehicle parts, textile and apparel will also contract. Mexico’s output gains in electrical equipment and machinery (categories which include electronics) are expected to offset these losses.

The U.S., Mexico and Canada signed USMCA November 30, but it remains to be ratified by the legislatures of each country. The U.S. is reported to be ready to lift the Section 232 tariffs on aluminum and steel which have been a stumbling block to Canadian and Mexican ratification. In the U.S., Congressional critics have raised concerns about the pact’s environmental and labor provisions as well as an extension of protections for pharmaceuticals from generic competition.

USMCA is far from a done deal. But, with all three partners dependent on North American markets for their exports (as the chart shows), a deal must be struck.

Related:

From our blog:

- Snapshot: U.S. Automobile Imports and Exports

- Truce Called in U.S.-China Trade War

- USTR Outlines Objectives in Renegotiating NAFTA

- Making Sense of Tariffs: What You Need to Know

- Market Changers: U.S. Section 232 Aluminum and Steel Tariffs

From our trade content solutions:

- Descartes CustomsInfo™ Manager helps clients minimize trade barriers with a vast database of regulations, rulings, duties, and more. Learn more.

- Descartes Datamyne international database covers Mexican Census import-export data as well as detailed data from declarations for in- and outbound shipments by all transportation modes. Ask for a demo.