Iran is readying the ground for resumption of petrochemicals exports as the nuclear deal it’s struck with six world powers, including the US, calls for lifting the sanctions that have throttled the country’s sales abroad and shrunk its economy by 20%.

As Platts reports, the impact of Iran’s full re-entry into global petrochemicals markets is hard to project, as it will depend on so many variables, including the pace of production ramp-up, the terms of deals to be struck with the newly privatized Iranian industry, and the easing of constraints on trade financing.

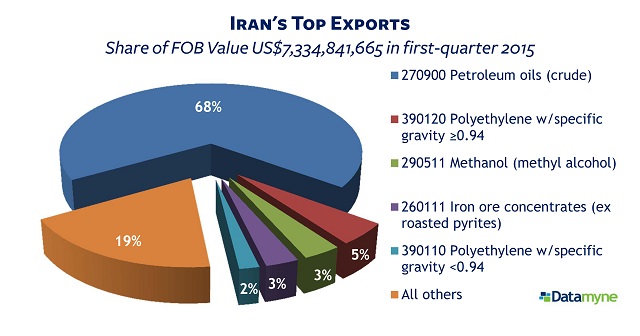

So, Iran remains a wild card for market forecasters, as we wrote in our March blog on polyethylene (PE), a bellwether for Iranian petrochemical exports. Our trade data on Iran ranks PE (HS 390110 and HS 390120) second by value among the country’s exports, accounting for about 7% of all Iranian exports in first-quarter 2015:

Platts projects Iranian PE production capacity will rise from today’s 3.7 million metric tons per year to at least 5.7 mt/year over the next decade.

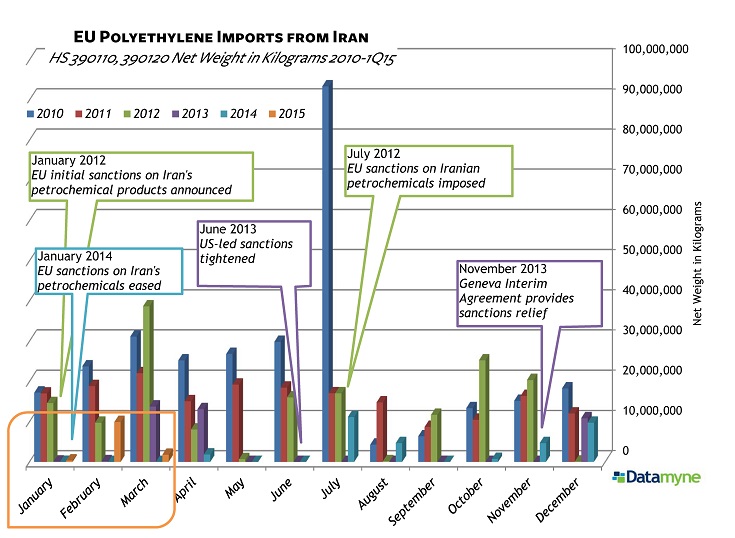

We promised in March to continue tracking the resurgence in EU imports of PE from Iran, which has proceeded in fits and starts since the November 2013 Geneva Agreement provided some relief from sanctions. Here’s the graph we ran then, updated with first-quarter 2015 data:

Related: