In June 2024, global trade data tracked by Descartes Datamyne shows that U.S. container imports decreased 2.1% from May but outpaced the same period last year by 10.4%. Imports from China remained flat in June but boasted a 13.8% growth over June 2023.

Key Takeaways from June 2024

- June 2024 U.S. imports grew 10.4% year-over-year.

- Port transit times for West Coast ports decrease overall, while East and Gulf Coast ports experienced increased delays.

- Panama Canal capacity continues to improve.

- Israel-Hamas war continues to threaten trade through the Middle East.

- Imports at Gulf Coast ports decreased in volume.

- The Port of Baltimore reopens.

- The potential for labor disruptions at South Atlantic and Gulf Coast ports later this year increased as contract talks stalled.

In June 2024, port transit delays improved for all top West Coast ports while East Coast port delays increased. Descartes’ July logistics metrics update shows that, despite a small month-over-month decline, U.S. import volumes remain strong when compared to the same time period in recent years. However, threats to the stability of global trade remain with continued instability in the Middle East and pending labor negotiations at the U.S. South Atlantic and Gulf Coast ports.

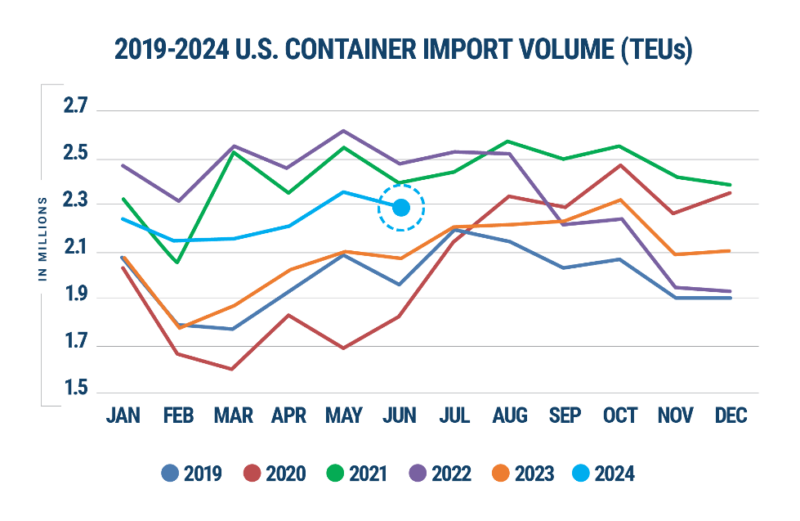

Increase in U.S. Container Imports Year-Over-Year

From May to June 2024, U.S. container import volumes decreased by 2.1% to 2,297,979 twenty-foot equivalent units (TEUs) (see Figure 1). Despite this month-over-month decrease, it represents the smallest May-to-June decline on record over the past six years, excluding the anomalous 2020 pandemic year. U.S imports saw an increase in volume compared to the same period last year, as June TEU volume rose by 10.4%

Figure 1: U.S. Container Import Volume Year-over-Year Comparison

Source: Descartes Datamyne™

West Coast Port Transit Delays Shorten While East Coast Delays Increase

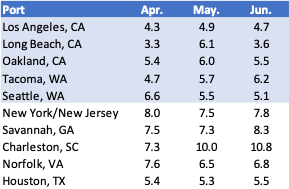

Except for Tacoma, transit delays at major West Coast ports in June 2024 improved, according to Descartes Datamyne global trade data, with the most notable decrease at the port of Long Beach (refer to Figure 2). However, East Coast ports experienced slight increases in delay averages compared to May, with the most notable increase at the port of Savannah.

Figure 2: Monthly Average Transit Delays (in days) at the Top 10 Ports

Source: Descartes Datamyne™

Note: Descartes’ definition of port transit delay is the difference as measured in days between the Estimated Arrival Date, which is initially declared on the bill of lading, and the date when Descartes receives the CBP-processed bill of lading.

Panama Canal Increases Daily Transits

In June, the Panama Canal Authority announced that starting July 11, daily transits would increase from 32 to 33, with another increase to 34 on July 22. An additional transit slot is scheduled to open on August 5, bringing the total to 35, just one short of the canal’s normal operating capacity of 36 daily transits.

Israel-Hamas War Threatens Middle East Trade

The Israel-Hamas conflict continues to threaten trade through the Middle East. Attacks and ongoing threats to shipping in the Red Sea by Yemeni Houthi forces are forcing shippers to divert cargo away from the Suez Canal to longer and more expensive routes. Shipping concerns are likely to increase if the region becomes further destabilized.

Port of Baltimore Reopens

Seventy-eight days after the collapse of the Francis Scott Key Bridge, the Port of Baltimore reopened on June 10. The 700-foot wide and 50-foot-deep channel has been fully restored and deemed “safe for transit” by the U.S. Army Corps of Engineers. June U.S. import volumes at the port reached 3,753 TEUs, significantly lower than the 45,435 TEUs recorded in June 2023. It remains uncertain if import volumes will return to pre-incident levels.

International Longshoremen’s Association (ILA) Suspends Negotiations with the United States Maritime Alliance (USMX)

On June 10, the ILA announced the suspension of negotiations with the USMX, which were scheduled for June 11. The potential trade disruption from the expiration of the ILA and USMX agreement, set for the end of September 2024, is currently unknown. If no resolution is reached, labor action could disrupt U.S. import volumes at these ports. ILA leadership has stated they do not intend to extend the current agreement and have advised members to prepare for a possible coast-wide strike in October 2024.

Managing Supply Chain Risks with Global Shipping Data

Trade data from June 2024 shows that U.S. import volumes are down from May 2024, but well above volumes from the previous year. Overall port transit times improved across West Coast ports while East Coast ports experienced further delays Daily transits continue to improve at the Panama Canal, the Port of Baltimore returns to full operation, and tensions in the Middle East are stressing global supply chains with the threat of further disruption throughout 2024. Descartes will continue to highlight key Descartes Datamyne, U.S. government and industry data in the coming months to provide insight into global shipping.

To mitigate risks related to the current state of the global supply chain, shippers and logistics providers have strategies they can deploy, including using global trade and shipping data to mitigate supply chain risk with the key objective of keeping their international business healthy and growing, and maintaining a satisfied customer base. These strategies include:

1. Short-term: To prepare for potential disruptions in 2024, evaluate the impact of an ILA strike on South Atlantic and Gulf Coast ports and identify alternate ports or trade lanes. Monitor East Coast port volumes to assess the recovery of the Port of Baltimore. Track the Panama Canal Authority’s progress on increasing daily transits. Monitor the Middle East conflict, as it affects shipping routes and capacity. Watch the spread of COVID variants, focusing on their impact on critical supply chain areas, especially in China. Track ocean shipments and carrier performance to address the gap between original and actual ETAs. Evaluate the impact of inflation and conflicts in Russia/Ukraine and Israel/Hamas on logistics costs and capacity constraints, ensuring key trading partners are not on sanctions lists.

2. Long Term: Assess the concentration of suppliers and factories to reduce reliance on overburdened trade lanes and regions prone to conflict. While density can offer economies of scale, it also poses risks, as highlighted by the pandemic and subsequent logistics capacity crisis. Conflicts rarely arise without warning, making it crucial to address this potentially disruptive issue now.

How Descartes Datamyne Global Shipping Data Can Help Manage Supply Chain Risks

Descartes Datamyne delivers global trade and shipping data with comprehensive, accurate, up-to-date, import information that helps U.S. importers save significant time in spotting supply and demand shifts, optimizing trade lanes, expanding into new markets, and identifying new buyers and suppliers.

Descartes Datamyne features the world’s largest searchable global trade database covering 230 markets across five continents. Gathered directly from official filings with customs agencies and trade ministries, including bills of lading, the data is detailed (down to company names and contact details), timely and authoritative.

Apart from providing trade intelligence via global trade and shipping data, Descartes software solutions also include a landed cost tool to calculate the economic viability of importing from a range of markets. Our applications can also screen against multiple denied parties lists simultaneously to help ensure organizations are not doing business with entities named on official government watch lists.

This is an excerpt of an article originally posted in the Descartes Global Shipping Crisis Resource Center. If you want to learn more about how Descartes Datamyne’s global trade and shipping data can help you, Contact Us

Note: This report uses the initial compiled release of U.S. Customs and Border Protection (CBP) data and is subject to revision later by CBP. The revised data can be seen in Descartes Datamyne.