Any company that relies on cross-border supply chains or sales needs to track and be ready to respond to the changing trade policies affecting global markets. The best way for businesses to stay ahead of these changes is through a robust Global Trade Management solution.

Market leaders need methods to stay ahead of trade negotiations, demonstrate reasonable care, discover what tariff adjustments affect which products, and if exceptions apply. It is also critical to be able to stream accurate, fully vetted trade data into existing Enterprise Resource Planning (ERP) platforms and other systems.

Proposals now on the table go beyond updating the North America Free Trade Agreement to redefining the 24-year-old trade relationship between Canada, Mexico and the U.S.

Negotiations to reboot NAFTA picked up again last week after their suspension in late May ahead of Mexico’s presidential election. The U.S. initiated the renegotiation of the trade pact with Canada and Mexico a year ago. The U.S. Trade Representative (USTR) laid out the objectives the U.S. hopes to achieve in revising NAFTA on July 17, 2017. The first round of formal talks opened 30 days later on August 16.

Through the first seven rounds of NAFTA negotiations, the U.S. has pushed to loosen perceived constraints on its ability to act unilaterally. Partners Canada and Mexico have resisted changes they see as undermining what has been a strong, mutually beneficial trilateral relationship.

NAFTA Negotiations: Sticking Points

Here are some of the key sticking points to be addressed in the eighth round:

- Sunset Clause: The U.S. wants NAFTA 2.0 to include a five-year sunset provision for automatically terminating the pact unless the partners agree to renew it. Mexico and Canada oppose a built-in termination date. Their concern is that a mandatory sunset would make the long-term outlook too uncertain for businesses. Mexico has said it is open to a provision for periodic review of the agreement. The U.S. has signaled the sunset provision might be pushed beyond five years.

- Dispute Resolution Opt-Out: The U.S. wants to be able to bow out of NAFTA’s mechanism for resolving disputes between corporations and states (the current agreement’s Chapter 11 covering investments). Canada and Mexico want these disputes settled by the trans-national panels rather than the U.S. courts. The U.S. also objects to the existing provision for appealing U.S. anti-dumping and countervailing duties (AD/CVD) decisions (covered in Chapter 19).

- Bi- vs. Trilateral Agreement. The U.S. is open to striking separate, bilateral agreements with each of its North American neighbors. Both Canada and Mexico want to stick with a three-way deal – even if that the new agreement is narrower in scope. They might, for instance, agree to drop some procedural provisions, such as the investor-state dispute resolution mechanism, from NAFTA 2.0. – as alternatives, such as the World Bank’s International Center for Settlement of Investment Disputes, are available.

NAFTA Negotiations: Trade Issues

The U.S. has also zeroed in on policies that shape trade in specific sectors. Top of the list:

- Dairy Products. Canada manages its supply of dairy products by matching domestic production to consumption and maintaining quotas that leave less than 10% of its market open to tariff-free imports. NAFTA left these dairy import controls in place. Then the U.S. introduced a new product – called ultrafiltered milk in the U.S., diafiltered in Canada – used to make cheese and yogurt. Because it was not expressly covered by existing trade and tariff rules, this milk product could enter Canada duty-free. Imports surged … until Canada created a new supply management “Class 7”of milk ingredients, including diafiltered milk, enabling Canadian dairy farmers to sell their milk ingredients at lower prices domestically and to export surpluses. With its exports of diafiltered milk down sharply, the U.S. has made ending the Class 7 pricing a priority.

- Autos and Auto Parts. Cars and parts make up roughly a quarter of U.S. two-way trade with its NAFTA partners. To move across borders duty-free these goods must comply with rules of origin: 62.5% of a car must be North American-made. For a separate “tracing” list of components that go into making that car, including axles, brakes and tires, only their North American value-add can count toward that 62.5%. The U.S. would boost the content requirement to a proposed 85% North American-made – with 50% U.S.-made. The U.S. would also like to see a much longer, more comprehensive tracing list of parts. For Canada and Mexico, the U.S. opening proposal was a non-starter. The U.S. has since put a 75% content requirement on the table.

NAFTA Negotiations: Complications

Further complicating the NAFTA negotiations is the U.S. strategy of deploying new tariffs in its larger quest to redefine the multilateral rules regulating global trade relations.

Thus NAFTA negotiations on auto and auto parts trade are set to proceed even as the U.S. conducts an investigation under Section 232 of the Trade Act of 1974 to determine whether imports of automobiles threaten to impair the national security. Protective tariffs on imported cars, SUVs, vans and light trucks, and parts are a possible outcome that would disrupt North American auto assembly lines. The Section 232 tariffs on aluminum and steel imposed earlier this year have triggered retaliatory tariffs from top U.S. trading partners, including Canada. [Here’s an infographic summary of the tit-for-tat tariffs traded through June.]

Ironically, Canada has said it will challenge the Section 232 aluminum and steel tariffs under the existing NAFTA provisions the U.S. seeks to modify, as well as filing a dispute at the WTO.

Will the NAFTA relationship survive? There is strong incentive to make it work.

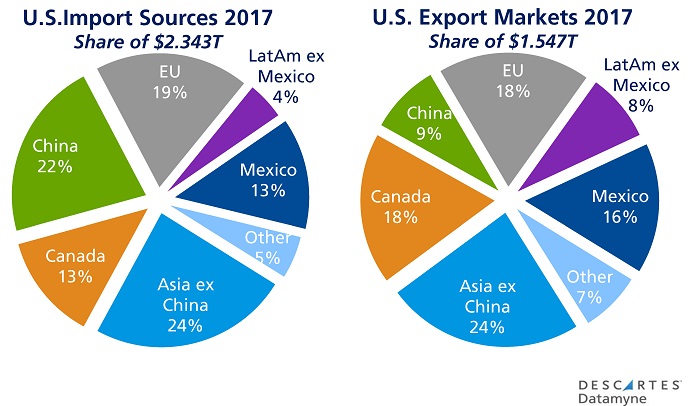

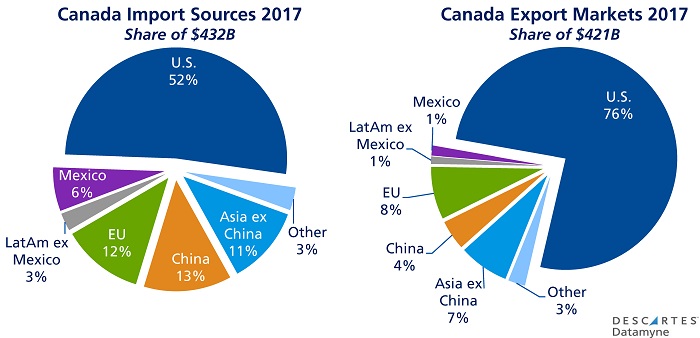

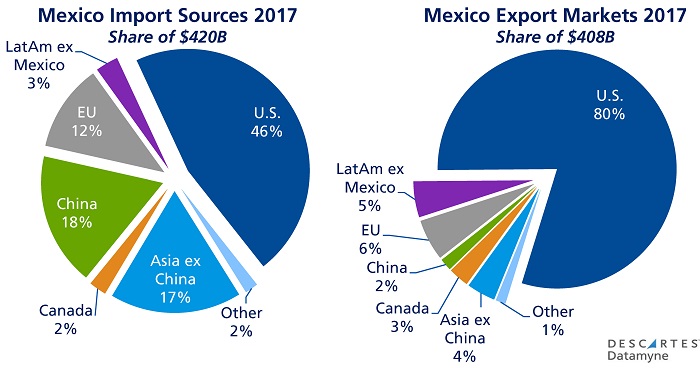

As the data charts above illustrate, each partner is a leading market for the others’ exports and a primary source of the others’ imports. They also make clear that the U.S. is somewhat less dependent than its North American partners on continental trade – a position the U.S. is leveraging. Both Canada and Mexico continue to signal they are willing to – indeed optimistic they can – reach a new agreement. On the eve of round eight, Mexico’s president-elect Andrés Manuel López Obrador affirmed his country’s commitment to concluding NAFTA negotiations. The key to striking a renewed deal will be flexibility – from all three partners.

Related:

Blog coverage:

- Making Sense of Tariffs: What You Need to Know

- Market Changers: U.S. Section 232 Aluminum and Steel Tariffs

- U.S. Deploys Protective Tariffs on Solar Panels, Washers

- U.S. Outlines Objectives in Renegotiating NAFTA

Trade content solutions:

- Descartes CustomsInfo™ Manager helps clients minimize trade barriers with a vast database of regulations, rulings, duties, and more. Learn more.

- Descartes Datamyne™ can provide a wealth of data on NAFTA trade including values and volumes by specific HS code. In addition, our maritime bill of lading data captures the transactional and logistical details of U.S. import trade – including consignees, shippers, and notify parties, cargo values and volumes. Ask for a demo.